FBAR and Title 31

Quaint?: U.S. Treasury 1998 Report: Income Tax Compliance by U.S. Citizens and U.S. Lawful Permanent Residents Residing Outside the United States and Related Issues (Part I of Part II)

This is a classic report that now reads quaintly.

This 1998 U.S. Treasury report was written before the IRS and the Department of Justice started enforcing what has now become numerous international information reporting penalty provisions in the law. The author watched the change over these years, and the introduction of some new statutory penalties (e.g., 26 USC § 6039F in 1996; § 6039D in 2010; § 6039G in 1996; and major modifications in 2010 to § 6048, among others and increased FBAR penalties). Most importantly, the biggest change was how international individual taxpayers can (and often are) severely penalized by the IRS.

This 1998 report is full of sensible ideas. The Treasury explains the complex tax laws applicable to United States citizens (“USCs”) and lawful permanent resident (“LPR”) residing outside the U.S. The report has suggestions on how to best educate international taxpayers living overseas who are impacted by these laws.

Fast forward more than 25 years later (post 9/11/2001; post USA Patriot Act of 2001; post Swiss Bank scandals 2009+; post FATCA 2010+, etc.) and we are in a world of international tax penalties galore.

The U.S. international tax world in 2024 is a very different world, even though the core of the U.S. international tax law of how much tax is owing has largely remained the same for individuals. The calculation of income taxes for USCs and LPRs living overseas in 2024 is largely the same as it was in 1998. Plus, the IRS reports that only 10,684 resident income tax returns (IRS Form 1040) were filed by these individuals living overseas in the last year the IRS Office of Statistics reporting tax returns with IRS Form 2555 (Foreign Earned Income).

What has changed over these years is the IRS enforcement and easy found money on penalty collections. One example is the penalty for reporting tax-free gifts and inheritances. The reporting requirement of that law (26 U.S. Code § 6039F – Notice of large gifts received from foreign persons) was adopted in 1996.

The IRS has been increasingly aggressive in asserting international tax penalties: The available data shows . . . there were over 4,000 penalties assessed against individuals and businesses, totaling $1.7 billion [just for this penalty under 6039F]. During this period, the average penalty was . . . $426,000 . . .

Taxpayer Advocate Report (2023): Most Serious Problem #8 – The IRS’s Approach to International Information Return Penalties Is Draconian and Inefficient

The IRS assessed US$1.7 billion of penalties for this simple 6039F reporting violation over the four years of 2018-2021. The 2018 amounts tripled or quadrupled in subsequent years (e.g., $77M v. $238M v. 282M). Not all of these taxpayers are residing overseas, but certainly USCs and LPRs residing outside the U.S. are likely to encounter foreign gifts and foreign bequests, simply because their lives are foreign!

On the flip side, there have been few favorable changes to the U.S. citizen and lawful permanent resident (“LPR”) living outside the U.S. over these 25 years.

The most favorable developments have come in the last year or so. Importantly, the U.S. Supreme Court rejected the IRS interpretation of multiple per year non-willful FBAR penalties in United States v. Bittner, 143 S. Ct. 713 (2023). The author of this blog worked on the ACTEC amicus brief in Bittner, cited by the majority opinion (Justice Gorsuch) and the dissent (Justice Sotomayor).

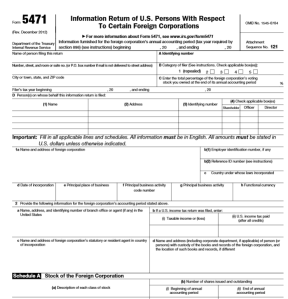

Also of significance for individuals living in tax treaty countries is the case of Mr. Aroeste. The author of this blog represents the Mexico City resident who had not formally abandoned his LPRs. The case law provides significant relief for different groups of international taxpayers pursuant per the ruling by the federal district court in Aroeste v United States, 22-cv-00682-AJB-KSC (20 Nov. 2023). That case had over $3M of penalties assessed for IRS Forms 5471, 3520 and FBAR filings.

Plus, the DOJ conceded the penalty assessed against a Polish immigrant for a foreign gift in Wrzesinski v. United States, No. 2:22-cv-03568, (E.D. Pa. Mar 7, 2023) for not filing IRS Form 3520 based upon reasonable cause. Finally, the U.S. Tax Court decision in Farhy v. Commissioner of Internal Revenue (2023) concluded the IRS could not automatically assess penalties for not filing IRS Form 5471.

Indeed, the international tax world has changed much over this past quarter century since the 1998 U.S. Treasury report. These recent string of cases in favor of international taxpayers is starting to look like a positive trend. See, Six Weeks, Three International Information Reporting Decisions (18 Sept. 2023).

More comments to come – in Part II.

This entry was posted in 2024, Corollary Tax Consequences, FATCA - Chapter 4, FBAR and Title 31, Lawful Permanent Residents, Penalties, Tax Compliance, Tax Treaties and tagged certificate of loss of nationality, citizenship taxation, expatriation, FATCA, lawful permanent resident.

Immigration Forms, I-407; I-485, Application to Register Permanent Residence or Adjust Status & Tax Forms, 1040, 1040NR, 8833, 5471, 8854, 8621, 3520, 8864, 8858 and FinCEN forms 114, etc. etc. (Part I of III)

The U.S. tax law is complex, including when an individual (i) becomes and (ii) ceases to be, a U.S. income tax resident (USITR). USITR is not a technical term used under the tax law. The U.S. tax and information reporting requirements are very different depending the status of an individual. Anyone who is not a United States citizen, is either a –

- “Resident alien“, or a

- “Nonresident alien” as the tax law defines both of these categories.

You can’t be both.

“Resident aliens” are generally also “United States persons” (both technical terms in the federal tax law).

“Non-resident aliens” as defined are necessarily not “United States persons.”

Being one versus the other has huge U.S. tax and reporting consequences.

An individual who is a “lawful permanent resident” as referenced in the tax law (Section 7701(b)(6)) cross-references the U.S. immigration law. The first requirement of that statutory tax rule in § 7701(b)(6)(A)) is that “(A) such individual has the status of having been lawfully accorded the privilege of residing permanently in the United States as an immigrant in accordance with the immigration laws [such status not having changed]. . .[emphasis added]” This means the tax definition is dependent upon the immigration laws, which are found in Title 8, Immigration and Nationality Act. Importantly, the last part of that sentence (i.e., [such status not having changed] is a requirement in the immigration law (Title 8), but does not appear in the tax definition.

The term “lawful permanent resident” cannot be found in Title 8 as a noun or object (i.e., the individual). Instead, the immigration law defines the status of a person in 8 U.S. Code § 1101(a) as follows:- “. . . (20) The term “lawfully admitted for permanent residence” means the status of having been lawfully accorded the privilege of residing permanently in the United States as an immigrant in accordance with the immigration laws, such status not having changed.“

This analysis is fundamental to be able to determine whether an individual who holds a “green card” in their pocket even has the status of being “lawfully admitted for permanent residence . . . such status not having changed.” It’s a fundamental legal question under immigration law that must be answered first, to then be able to answer the tax question.

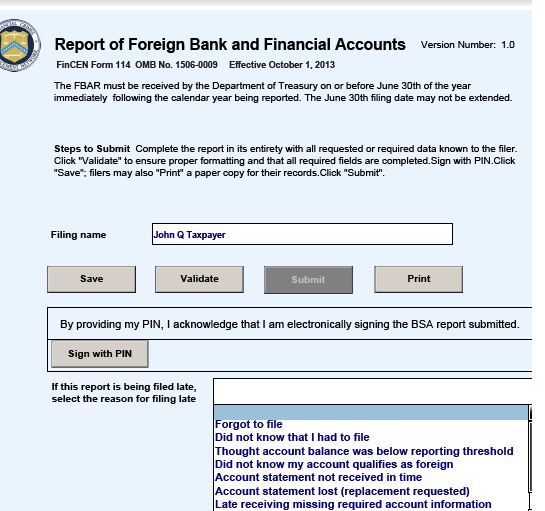

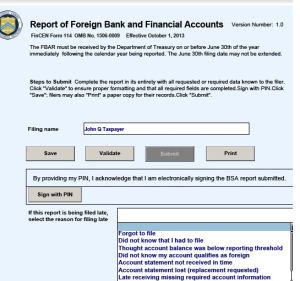

Each form an individual files or does not file (e.g., IRS tax form 1040 v. 1040NR; 8833, 5471, 8854, 8621, 3520, 8864, 8858 and FinCEN forms 114; and immigration forms, e.g., I-485, I-407, etc.) can have a potential impact on the tax residency status of an individual.

The immigration law and when forms, such as Form I-485, Application to Register Permanent Residence or Adjust Status are submitted to the U.S. federal government can have an impact on this determination. The government can use it against the individual as they did unsuccessfully in Aroeste (see below – Pages 9 and 11 of 17); asserting that Mr. Aroeste waived the treaty by not submitting certain forms.

See an earlier post that explains in some detail how and when an individual can cease to be a “United States person” if they live in a country with an income tax treaty and yet retained their “green card” in their pocket: Federal District Court Rules in Favor of Mexican Citizen – Aroeste vs. United States (LPR) – Tax Treaty Applies: Government’s Motion for Summary Judgment is Denied

The entire case from the Federal District Court can be read here: Aroeste v. United States, 22-cv-00682-AJB-KSC (20 Nov. 2023):

The tax residency analysis for those who have kept their “green card” in their pocket, can be even more complex as was analyzed by the Court. There are additional provisions of the law that must be considered including old Treasury Regulations that pre-date many provisions of various U.S. income tax treaties.

For instance, each of the following federal tax statutory rules, which will be considered in more detail in later posts (II and III):

- 26 U.S. Code § 894 – Income affected by treaty

- 26 U.S. Code § 7852(d) – Other applicable [treaty] rules

Additional posts will review the impact of these provisions in the law and how various immigration forms (including I-485 and I-407, Record of Abandonment of Lawful Permanent Resident Status) and tax forms (including 1040 v. 1040NR; 8833, 5471, 8854, 8621, 3520, 8864, 8858) and FinCEN form 114, can impact the determination of whether someone who has a “green card” in their pocket is or is not a United States person.

This entry was posted in 2024, Collateral Consequences - Non-Tax, Corrallary Tax Consequences, Covered Gifts and Bequests, FBAR and Title 31, Immigration Law Considerations, Lawful Permanent Residents, Tax Compliance, Tax Treaties and tagged #FBAR, #greencard, #internationaltax, #lawfulpermanentresident, #taxtreaty.

DHS Report: 3.89M Emigrated LPRs — Who Falls Under the Tax Treaty Escape Hatch?

Clear U.S. tax and legal relief now exists for a significant portion of the 3.89 million Lawful Permanent Residents (LPRs) who never formally abandoned their U.S. immigration status. This relief stems from two sources in the law:

(i) Tax treaty laws that apply to individuals residing in one of the 67 income tax treaty countries with the United States, recently including Chile.

(ii) Legal principles, recently confirmed by the Federal Court in Aroeste v. United States, that establish that individuals can apply tax treaty laws (when applicable) even if they missed certain filing deadlines set by the Internal Revenue Service. The Court termed this provision an “escape hatch,” allowing individuals, depending on specific circumstances, to be considered non-residents of the United States (not “United States persons”). This can be true under the relevant treaty, even if they never formally abandoned their LPR status.

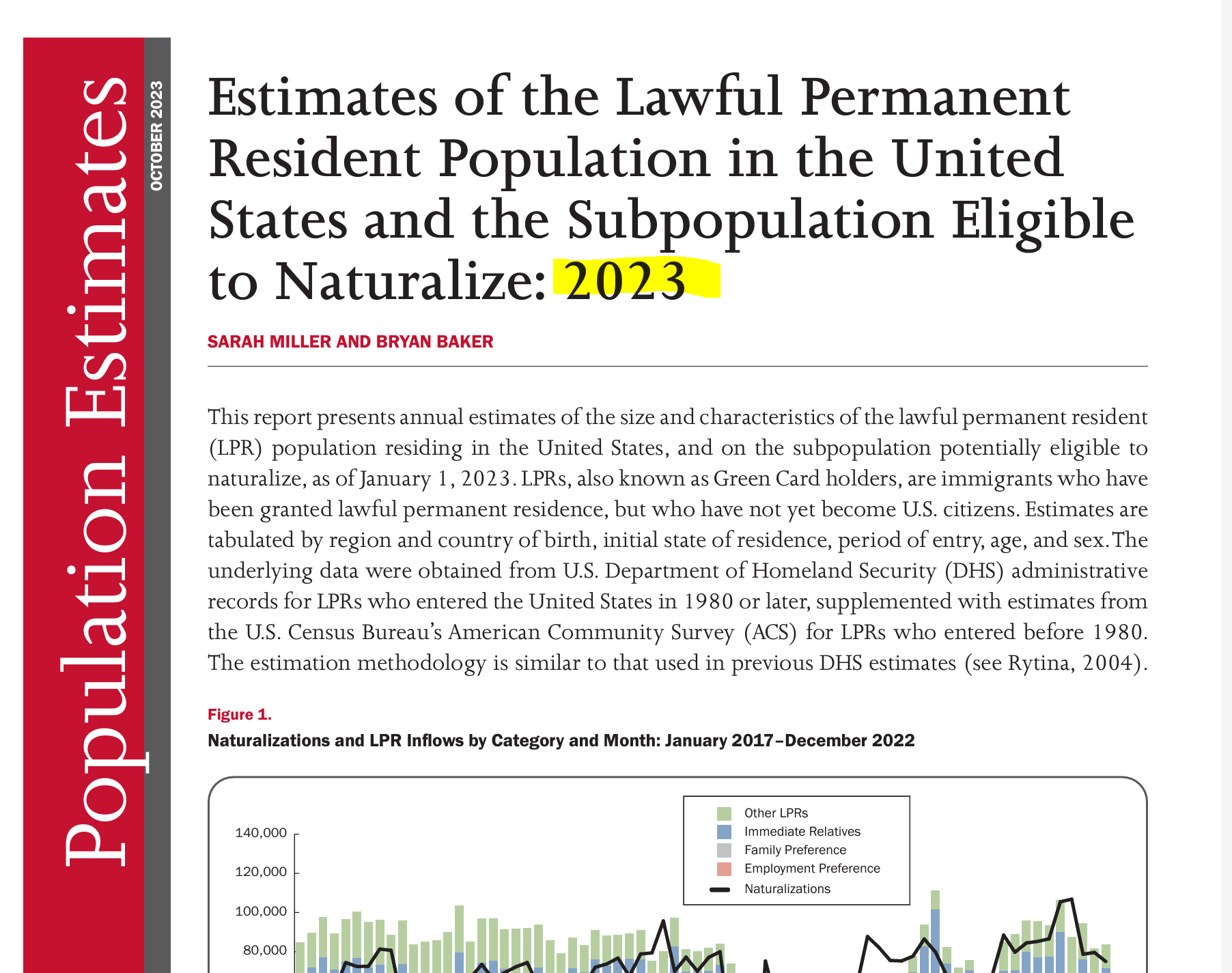

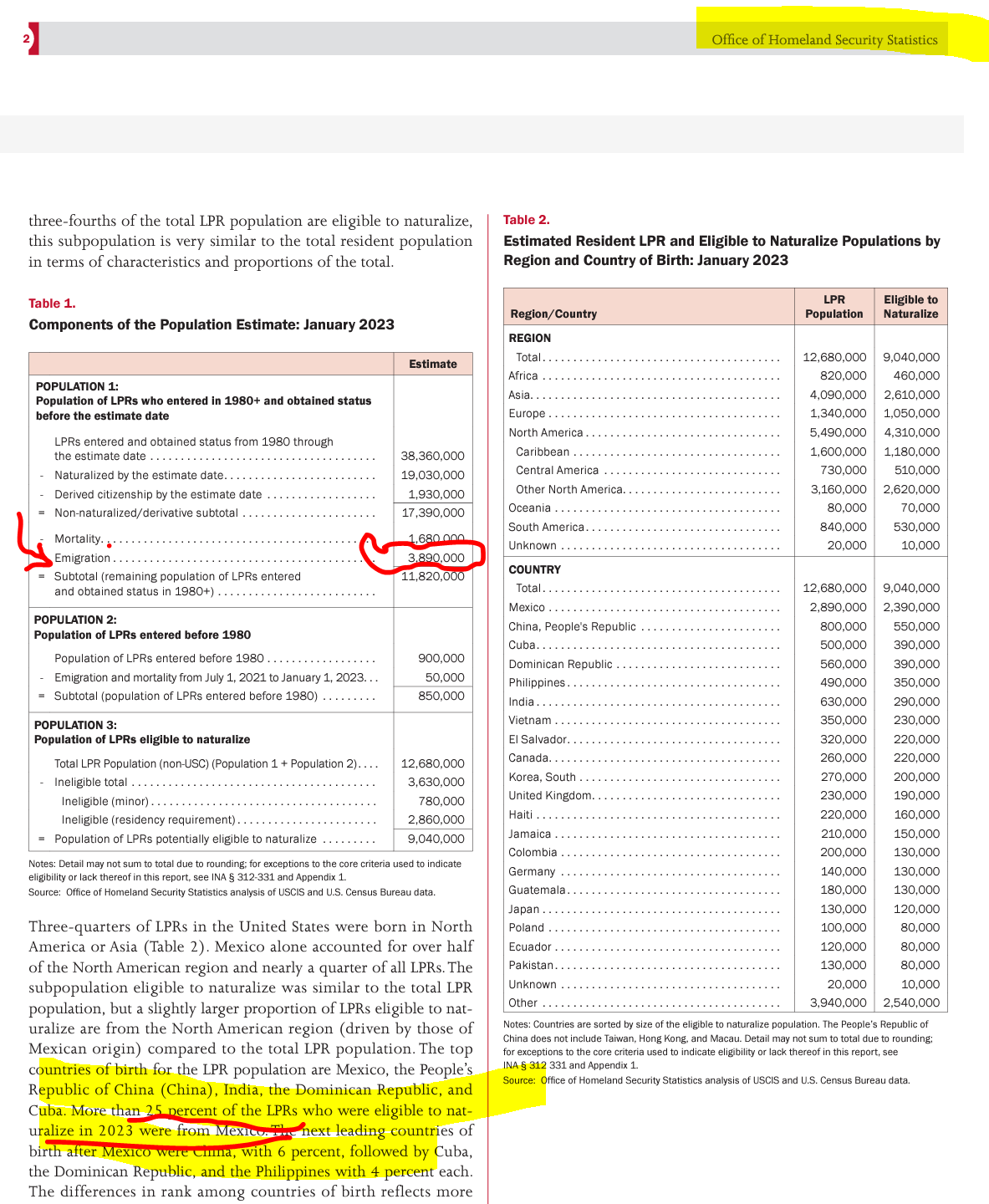

The 2023 DHS report estimates that nearly 4 million individuals have emigrated from and left the United States and are now living somewhere around the world. Notably, Mexico constitutes the largest share at about 25% of the total LPR population who have left the United States.

The United States has a total of 59 income tax treaties covering 67 countries. See, Countries with U.S. Income Tax Treaties & Lawful Permanent Residents (“Oops – Did I Expatriate”?) (2014).

The DHS report allows the reader to extrapolate that around 1 million individuals, similar to Mr. Aroeste, are living in Mexico and did not formally abandon their LPR status by filing Form I-407, Record of Abandonment of Lawful Permanent Resident.

Aroeste v. United States is the third case I’ve litigated, examining whether individuals with a “green card” residing outside the United States in a tax treaty country are considered U.S. income tax residents. The previous two cases (involving Mexican and German citizens) didn’t progress to the oral argument stage; as the government conceded both before trial. See, IRS Chief Counsel Concedes Tax Treaty Residency Position for LPR German Taxpayer in Tax Court

How many individuals currently living in Mexico have not officially abandon their LPR status by filing Form I-407, Record of Abandonment of Lawful Permanent Resident? See an earlier post reflecting different legal consequences to these individuals: Few LPRs Who Leave (Emigrate from) the U.S. Formally Abandon their Immigration Status: Important Tax Consequences (Part I) See notations below from Table 1 and throughout the Full Report here: Estimates of the Lawful Permanent Resident Population in the United States and the Subpopulation Eligible to Naturalize: 2023

A FOIA response yielded surprising information; the government records indicate that only 46,364 Forms I-407 were filed from 2013 to 2015.

(Source: Federal Government Response to FOIA Request: Office of Performance and Quality (OPQ), Performance Analysis and External Reporting (PAER), JJ)

What can we glean from the DHS report and the LPR – I-407 information obtained through the FOIA response? There is a substantial gap in the millions; millions of individuals who have physically left the U.S. to reside elsewhere globally, compared to the relatively smaller number of tens of thousands who have officially filed Form I-407, Record of Abandonment of Lawful Permanent Resident.

- Conclusion

Importantly, now under the legal principles established in Aroeste v. United States, individuals residing in one of the 67 countries covered by an income tax treaty have specific legal relief from the worldwide reporting of income to the United States government.

This entry was posted in 2023, Collateral Consequences - Non-Tax, Corollary Tax Consequences, FBAR and Title 31, Immigration Law Considerations, Lawful Permanent Residents, Tax Compliance, Tax Treaties and tagged expatriation, lawful permanent resident.

Mérida – the Place to be in February (19th and 20th)

The implications of the Aroeste v United States – Order (Nov 2023) particularly for millions of taxpayers globally and “U.S.” taxpayers affected by pertinent tax treaty provisions, will be a focal point of discussion at the upcoming international tax conference in February.

The University of San Diego School of Law – Chamberlain International Tax Institute will take place on February 19th and 20th, 2024, at the International Convention Center in Mérida, Yucatán, México. You can register for the conference – HERE –

Among the courses offered, there will be a detailed examination of- Aroeste v. the United States: Limits on Government Authority Re: Tax Treaty Law ++– along with other international tax topics and sessions featuring much Moore:

- United States Supreme Court – Tax Decisions & Moore

- International Tax Reporting: New Reporting of International Partnerships – K-2s & K-3s

- United States-based Cross-Border Real Estate Investments (Advanced)

- U.S. Investor Visa Options and Limitations

- California, Texas & Florida Probate Proceedings of Cross-Border Estates

- Corporate Transparency Act/anti-money-laundering FinCEN Reporting

- Avoiding Estate Taxes on U.S. – “Situs” Assets (risks in the Bolsa and opportunities)

- Latest Developments in International Corporate Reorganizations

- Check the Box Planning Including Pre-Immigration (Asset Planning – + International Companies)

- Pitfalls of International Trusts with U.S. Beneficiaries (in a high-interest rate environment)

- EB-5 Visa Requirements and Tax Implications

- Aroeste v. the United States: Limits on Government Authority Re: Tax Treaty Law ++

- Pillar 2 in Effect: First Qtr 2024 Planning & Compliance + Pillar 1 with Public Comments – December 11th, 2023

- Expiring TCJA International Tax Provisions: 2025 Soon Upon Us

- International Tax Advisors: How to – “Go directly to Jail, Do Not Pass “GO”, Do Not Collect $200!”

- International IRS & SAT Collection Enforcement – (cross-border tax judgments and liens)

- Cross-Border Aircraft Acquisitions, Financing and Leasing; Taxes, Aircraft Registration & Permitting

- Tax Treaty Interpretation – Malta Pension Plans ++

This entry was posted in 2023, FBAR and Title 31, Immigration Law Considerations, Lawful Permanent Residents, Tax Compliance, Tax Treaties and tagged expatriation, lawful permanent resident, taxation, The University of San Diego School of Law - Chamberlain International Tax Institute.

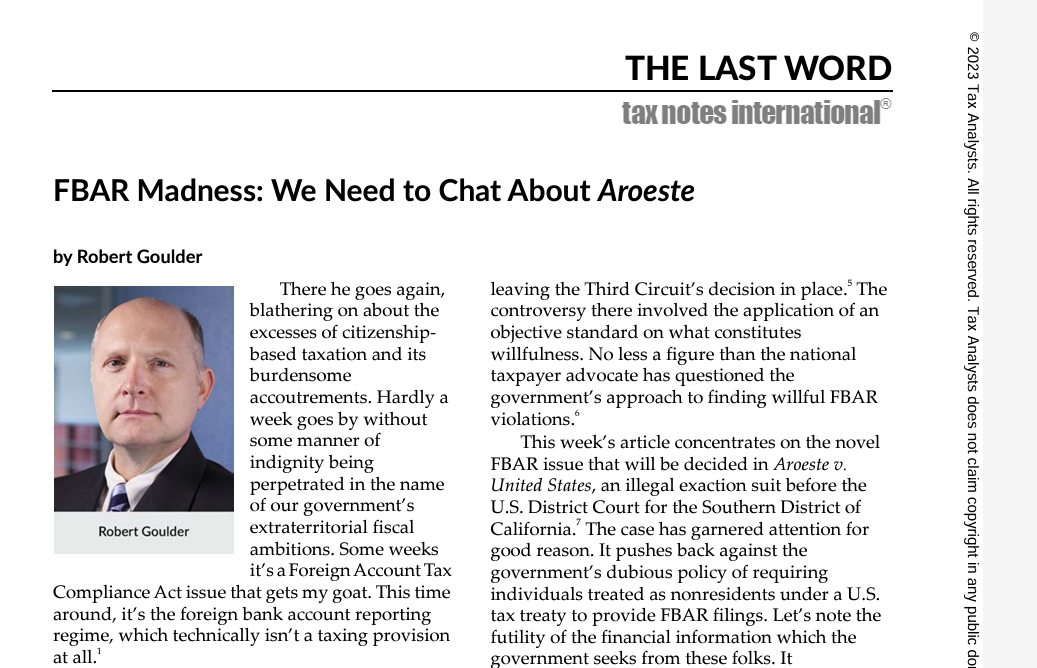

Recent Articles re: Aroeste v. United States (Tax Treaty – Nonresident; Lawful Permanent Resident) – IRS Notice 2009-85 Lacks Authority

There have been numerous articles being written about the key case of the author (Patrick W. Martin) who has represented Mr. and Mrs. Aroeste for nearly 8 years.

See, in Aroeste v. United States, Case No. 22-cv-00682-AJB-KSC. Aroeste v United States – Order Nov 2023

Below are a list of these articles as of December 31, 2023:

Court addresses FBAR requirement for dual residents with treaty foreign residency

16 December 2023

United States – Individual Not Required to File FBAR Under U.S.-Mexico Treaty

GMS Flash Alert 2023-226

Mexican Treaty Dual Resident Scores Big Win in FBAR Dispute

Tax Notes International – FBAR Madness: We Need to Chat About Aroeste.

US Can’t Seek FBAR Penalties From Green Card Holder

Six Weeks, Three International Information Reporting Decisions

“Mexican Treaty Dual Resident Scores Big Win in FBAR Dispute,” Tax Notes

Six Weeks, Three International Information Reporting Decisions

Taxpayer Wins Big In Federal Court—Tax Treaty Governs FBAR Reporting

This entry was posted in 2023, FBAR and Title 31, Lawful Permanent Residents, Tax Compliance, Tax Treaties.

A “Resident” is a “Resident” is a “Resident” – or Not?

Who is a “resident”? What is a “resident”? This sounds like such a basic question. It is not so simple for tax purposes; nor for other provisions of the law.

There is the colloquial meaning of resident. For instance, if Mr. Smith says, “I have been a resident of Montana on my ranch for 30 years”; to what does he refer? What if Mr. Smith has a house in California (which he has owned for 15 years) and another ranch in Alberta, Canada that he has owned for 45 years. Is he also a “resident” of Canada and California?

What if he is not a U.S. citizen but holds a particular type of visa, such as lawful permanent residency (an immigrant visa)? What if he has a non-immigrant visa, such as an E-2 visa? What if he only spends 4 months a year on his ranch in Montana, of where is he a “resident”?

Is he a “resident” in some or all of these scenarios? Why is this important in the context of “U.S. expatriation taxation”?

There are three sources of federal law where it becomes very important, which will be discussed in later posts:

- Title 31 – which is the “bank secrecy” law that creates the “FBARs” – see a prior post, Nuances of FBAR – Foreign Bank Account Report Filings – for USCs and LPRs living outside the U.S.

- Title 26 – federal tax law that has a myriad of definitions regarding “residents”; see, Oops…Did I “Expatriate” and Never Know It: Lawful Permanent Residents Beware! International Tax Journal, CCH Wolters Kluwer, Jan.-Feb. 2014, Vol. 40 Issue 1, p9.

- Title 8 – federal immigration law; see, Part II: Who is a “long-term” lawful permanent resident (“LPR”) and why does it matter?

In addition, various states, such as California, Texas and Washington D.C. (actually not a state; but all places I happen to be licensed to practice law) have their own definitions of who are “residents” for income tax and other purposes.

Subsequent posts will discuss the importance of understanding who is a “resident” and the implications under these various laws.

Laymen regularly have an idea of where they are “resident” – but that idea is often very different from definitions of “resident” under federal Titles 31, 26 and 8 and state laws (e.g., Texas, D.C., Florida, California, New York, etc.).

This entry was posted in Collateral Consequences - Non-Tax, FBAR and Title 31, Lawful Permanent Residents, Tax Compliance and tagged immigration, IRS, tax returns, taxation, Title 31 FBAR.

Will U.S. Tax Law Regarding “Covered Expatriates” get Modified with Recent Government Push in International?

It is rare to have the President of the United States hold press conferences specifically dealing with international tax policy and tax enforcement. Nevertheless, this is what happened last week when President Obama announced his administration’s recent efforts in the field of international tax, anti-corruption and financial transparency.

His remarks can be watched here: President Obama’s Efforts on Financial Transparency and Anti-Corruption: What You Need to Know

Also, the White House is putting forward a series of initiatives in this area:

To date, none of the specific initiatives address current “tax expatriation law” under IRC Sections 877, 877A, et. seq.

This entry was posted in Collateral Consequences - Non-Tax, Criminal Tax Considerations, FATCA - Chapter 4, FBAR and Title 31, Lawful Permanent Residents, Penalties, Tax Compliance, Tax Policy and tagged citizenship renunciations, citizenship taxation, FATCA.

IRS Creates “International Practice Units” for their IRS Revenue Agents in International Tax Matters

The U.S. international tax law has become increasingly complex. I am confident when I say that very few individuals in the world (including IRS revenue agents) understand the complexities of Title 26 and Title 31 as they apply to  international matters such as gifts of foreign property, gifts involving U.S. intangible property, gifts to or inheritances from foreign estates with U.S citizens (USCs) or Lawful Permanent Residents (LPRs) beneficiaries, foreign partnerships with USCs, transfers of property to foreign trusts by USCs or LPRs residing outside the U.S., transfers of property to foreign corporations, etc.

international matters such as gifts of foreign property, gifts involving U.S. intangible property, gifts to or inheritances from foreign estates with U.S citizens (USCs) or Lawful Permanent Residents (LPRs) beneficiaries, foreign partnerships with USCs, transfers of property to foreign trusts by USCs or LPRs residing outside the U.S., transfers of property to foreign corporations, etc.

Most USCs and LPRs who live in the U.S. certainly know and understand the basics of IRS Form 1040.

However, the type and scope of international transactions contemplated by the law can be significant and are rarely understood in any depth, even by many tax professionals. I have seen cases during my career of sophisticated individuals ranging from Nobel prize winners to U.S. Ambassadors, who had not a clue about the application of U.S. federal tax law to their lives. See, the Nov. 2, 2015 post, Why Most U.S. Citizens Residing Overseas Haven’t a Clue about the Labyrinth of U.S. Taxation and Bank and Financial Reporting of Worldwide Income and Assets

The lack of knowledge of these complex laws within the IRS, and the LB&I (Large Business and International group) which specializes in international matters has led to IRS “International Practice Units”. These are designed to allow IRS revenue agents who are not necessarily specialists in the international tax area to review transactions and be prepared to assess taxes and penalties against USCs and LPRs in the international context. The preamble says in part ” . . . Practice Units provide IRS staff with explanations of general international tax concepts as well as information about a specific type of transaction. . . ”

There are currently 63 different IRS “International Practice Units” all with dates from the last 12 months. Several of them focus heavily on information return filings which carry stiff penalties, even if no U.S. income taxes are owing. For instance see, Monetary Penalties for Failure to Timely File a Substantially Complete Form 5471 –Category 4 & 5  Filers.

Filers.

Another interesting IRS International Practice Unit is titled – Basic Offshore Structures Used to Conceal U.S. Person’s Beneficial Ownership of Foreign Financial Accounts and Other Assets.

These IRS materials give a good perspective from where the IRS views the world; including the introduction to this particular IRS International Practice Unit where it states: “This Practice Unit focuses on a U.S. Person’s proactive steps to “conceal” their ownership of foreign financial accounts, entities and other assets for the purposes of tax avoidance or evasion, even though, there may be some situations where there are legitimate personal or business purposes for establishing such arrangements. This unit falls under the outbound face of the matrix and thus, will focus on U.S Persons living in the United States . . . Most U.S. taxpayers using an offshore entity or structure of entities to hold foreign accounts are simply hiding the accounts from the Internal Revenue Service and other creditors . . .” [emphasis added]

This is a breathtaking statement from the IRS internal training manuals that “Most U.S. taxpayers using an offshore entity or structure of entities to hold foreign accounts are simply hiding the accounts from the Internal Revenue Service and  other creditors . . .”?

other creditors . . .”?

The vast majority of the USCs or LPRs who I see who renounce or abandon their citizenship or LPR status, are living outside the United States and in most cases have spent almost all (if not all) of their lives outside the U.S.

Does the IRS mean that a family living in Switzerland that have dual national family members are “. . . .simply hiding the accounts from the Internal Revenue Service . . . ” if they are using, for instance, a Liechtenstein Stiftung to hold their family assets as part of an estate plan recommended to them by their Swiss legal and tax advisers?

Does the statement that this IRS International Practice Unit focuses on ” . . . U.S Persons living in the United States . . . ” give USCs and LPRs residing outside the U.S. relief from the IRS perspective of USCs simply hiding assets from the Internal Revenue Service? Will IRS revenue agents be sophisticated enough to distinguish between these two different groups; U.S. resident versus non-resident USCs and LPRs? Will the law be applied differently with respect to these resident versus non-resident U.S. taxpayers?

What role will these IRS “International Practice Units” play in forming perceptions and molding ideas of IRS revenue agents who have had little to no life experience in international affairs, multi-national families, global finance and international business operations?

More observations to come from specific IRS “International Practice Units.

This entry was posted in Criminal Tax Considerations, FBAR and Title 31, Lawful Permanent Residents, Penalties, Tax Audits, Tax Compliance.

Foreign Government Criticizes U.S. Government for NOT Providing FATCA IGA Information on Their Taxpayers with U.S. Accounts

This news is ironic. The U.S. government has chastised various banks and governments around the world since 2009 for not providing financial information on U.S citizens (USCs) and other U.S. taxpayers regarding their foreign bank and financial accounts. See, How Congressional Hearings (Particularly In the Senate) Drive IRS and Justice Department Behavior, posted Sept 8, 2014.

Now, it is foreign governments’ turn, to criticize the U.S. Treasury and IRS for not keeping up with its promises to provide U.S. financial and bank information on taxpayers of their countries pursuant to all of the FATCA Intergovernmental Government Agreements (IGAs) that were pushed so hard by U.S. Treasury. See, FATCA IGA with Hong Kong Signed: U.S. Citizens and Lawful Permanent Residents Residing in or Around Hong Kong Need to Know, posted on Nov. 17, 2014.

The Commissioner of the Mexican IRS (SAT – Servicio de Administración Tributaria (SAT)), Mr. Aristóteles Núñez Sánchez just announced that the U.S. government is not holding up its side of the bargain under the U.S.-Mexico IGA. See, the Dec. 12, 2015 article en the national Mexican newspaper, El Universal, EU incumple entrega de informacion: SAT: Mexico ha hecho su parte, asegura Aristóteles Núñez

The article, which is in Spanish, explains that Mexico has complied with its obligations under the IGA by providing detailed information about U.S. taxpayers with accounts in Mexican financial institutions to the U.S. government. However, the U.S. government has not complied with its side of the bargain. The news report says no specific details were provided by Mr. Núñez about what type of information was provided.

This entry was posted in FATCA - Chapter 4, FBAR and Title 31, Tax Policy and tagged citizneship taxation, FATCA, fatca iga, iga.

Revocation or Denial of U.S. Passport: More on new section 7345 (Title 26/IRC) and USCs with “Seriously Delinquent Tax Debt”

New Section 7345 completely modifies how U.S. citizens (“USCs”) living and traveling around the world have to now consider very seriously actions taken by the Internal Revenue Service (“IRS”). It is the IRS which now holds the power under this new law that requires the U.S. Department of State (“DOS”) to revoke or deny to issue a U.S. passport in the first place.

New Section 7345(e) provides in relevant part as follows: “upon receiving a certification described in section 7345 of the Internal Revenue Code of 1986 from the Secretary of the Treasury, the Secretary of State shall not issue a passport to any individual who has a seriously delinquent tax debt described in such section. . . ” [emphasis added].

This new law mandates (not at the discretion of the DOS) that various U.S. passports be denied at the direction of the IRS. Once the IRS issues the certification of “seriously delinquent tax debt.”

All it takes, is for the IRS to claim tax or penalties are owing of at least US$50,000 through an assessment (plus start a lien or levy action).

Of course, US$50,000 sounds like a large sum for many modest USCs, until an individual understands that there are a host of international reporting requirements for taxpayers. Specifically, the IRS can impose a US$10,000 penalty for each violation of failing to complete and file various IRS information forms; EVEN IF NO income  taxes are owing. See IRS website – FAQs 5 and 8 regarding civil penalties (see also How is the offshore voluntary disclosure program really working? Not well for USCs and LPRs living overseas).

taxes are owing. See IRS website – FAQs 5 and 8 regarding civil penalties (see also How is the offshore voluntary disclosure program really working? Not well for USCs and LPRs living overseas).

For a summary of these forms and filing requirements, see a prior post, Oct. 17, 2015, Part II: C’est la vie Ms. Lucienne D’Hotelle! Tax Timing Problems for Former U.S. Citizens is Nothing New – the IRS and the Courts Have Decided Similar Issues in the Past (Pre IRC Section 877A(g)(4))

Indeed, our office has seen and assisted numerous taxpayers around the world where the IRS has assessed tens of thousands, hundreds of thousands and in some cases in excess of US$1M (in proposed assessments) against an individual for failure to simply file information reporting forms. See, for instance, a prior post on Nov. 2, 2015, Why Most U.S. Citizens Residing Overseas Haven’t a Clue about the Labyrinth of U.S. Taxation and Bank and Financial Reporting of Worldwide Income and Assets

Also, we have seen several IRS assessments of income tax (not just penalties) against individuals of hundreds of thousands of dollars which are not supported by the law. For instance, it is not uncommon for the IRS to issue a “substitute for return” alleging income taxes owing. See, How the IRS Can file a “Substitute for Return” for those USCs and LPRs Residing Overseas, posted Nov. 8, 2015. We have a number of those cases pending, where the IRS has taken erroneous information and made such assessments against USCs residing and working outside the U.S. for much if not most of their professional lives.

New Section 7345 requires that USCs, wherever they might reside, take great care in knowing about any actions the IRS might be taking against them; as to tax and penalty assessments, whether or not they are supported under the law.

One basic method of learning more about the activities of the IRS is to make a transcript request directly to the IRS regarding the status of a USC’s federal tax status according to IRS records. See, IRM, Part 21. Customer Account Services . . . Section 3. Transcripts.

It is also possible for the USC to obtain additional tax information from the IRS through a Freedom of Information Act (“FOIA”) request.

This entry was posted in Corollary Tax Consequences, FBAR and Title 31, Lawful Permanent Residents, Penalties, Social Security - Non-Tax Considerations, Tax Compliance, U.S. Department of State and tagged citizenship taxation, FATCA, passport rejection, passports and SSNs.