Social Security – Non-Tax Considerations

Revocation or Denial of U.S. Passport: More on new section 7345 (Title 26/IRC) and USCs with “Seriously Delinquent Tax Debt”

New Section 7345 completely modifies how U.S. citizens (“USCs”) living and traveling around the world have to now consider very seriously actions taken by the Internal Revenue Service (“IRS”). It is the IRS which now holds the power under this new law that requires the U.S. Department of State (“DOS”) to revoke or deny to issue a U.S. passport in the first place.

New Section 7345(e) provides in relevant part as follows: “upon receiving a certification described in section 7345 of the Internal Revenue Code of 1986 from the Secretary of the Treasury, the Secretary of State shall not issue a passport to any individual who has a seriously delinquent tax debt described in such section. . . ” [emphasis added].

This new law mandates (not at the discretion of the DOS) that various U.S. passports be denied at the direction of the IRS. Once the IRS issues the certification of “seriously delinquent tax debt.”

All it takes, is for the IRS to claim tax or penalties are owing of at least US$50,000 through an assessment (plus start a lien or levy action).

Of course, US$50,000 sounds like a large sum for many modest USCs, until an individual understands that there are a host of international reporting requirements for taxpayers. Specifically, the IRS can impose a US$10,000 penalty for each violation of failing to complete and file various IRS information forms; EVEN IF NO income  taxes are owing. See IRS website – FAQs 5 and 8 regarding civil penalties (see also How is the offshore voluntary disclosure program really working? Not well for USCs and LPRs living overseas).

taxes are owing. See IRS website – FAQs 5 and 8 regarding civil penalties (see also How is the offshore voluntary disclosure program really working? Not well for USCs and LPRs living overseas).

For a summary of these forms and filing requirements, see a prior post, Oct. 17, 2015, Part II: C’est la vie Ms. Lucienne D’Hotelle! Tax Timing Problems for Former U.S. Citizens is Nothing New – the IRS and the Courts Have Decided Similar Issues in the Past (Pre IRC Section 877A(g)(4))

Indeed, our office has seen and assisted numerous taxpayers around the world where the IRS has assessed tens of thousands, hundreds of thousands and in some cases in excess of US$1M (in proposed assessments) against an individual for failure to simply file information reporting forms. See, for instance, a prior post on Nov. 2, 2015, Why Most U.S. Citizens Residing Overseas Haven’t a Clue about the Labyrinth of U.S. Taxation and Bank and Financial Reporting of Worldwide Income and Assets

Also, we have seen several IRS assessments of income tax (not just penalties) against individuals of hundreds of thousands of dollars which are not supported by the law. For instance, it is not uncommon for the IRS to issue a “substitute for return” alleging income taxes owing. See, How the IRS Can file a “Substitute for Return” for those USCs and LPRs Residing Overseas, posted Nov. 8, 2015. We have a number of those cases pending, where the IRS has taken erroneous information and made such assessments against USCs residing and working outside the U.S. for much if not most of their professional lives.

New Section 7345 requires that USCs, wherever they might reside, take great care in knowing about any actions the IRS might be taking against them; as to tax and penalty assessments, whether or not they are supported under the law.

One basic method of learning more about the activities of the IRS is to make a transcript request directly to the IRS regarding the status of a USC’s federal tax status according to IRS records. See, IRM, Part 21. Customer Account Services . . . Section 3. Transcripts.

It is also possible for the USC to obtain additional tax information from the IRS through a Freedom of Information Act (“FOIA”) request.

This entry was posted in Corollary Tax Consequences, FBAR and Title 31, Lawful Permanent Residents, Penalties, Social Security - Non-Tax Considerations, Tax Compliance, U.S. Department of State and tagged citizenship taxation, FATCA, passport rejection, passports and SSNs.

USCs without a Social Security Number (and a Passport) Cannot Travel to the U.S.

Recent posts have focused on the dilemma facing U.S. citizens (USCs) who have no social security number (“SSN”). See an older post (23 July 2014) – Why do I have to get a Social Security Number to file a U.S. income tax return (USCs)?

These problems are quickly coming to the surface, now that financial institutions  (“FFIs”) around the world and private companies and trusts (e.g., non-financial foreign entities -NFFEs) must have their owners and clients certify they are not U.S. citizens; OR report the accounts of such U.S. citizens to the IRS under FATCA and the intergovernmental agreements (“IGAs”).

(“FFIs”) around the world and private companies and trusts (e.g., non-financial foreign entities -NFFEs) must have their owners and clients certify they are not U.S. citizens; OR report the accounts of such U.S. citizens to the IRS under FATCA and the intergovernmental agreements (“IGAs”).

The intricacies of this problem are highlighted in a technical paper I recently drafted and presented to the U.S. Treasury Department and the Joint Committee of Taxation, among other federal government groups. Some key excerpts of that paper titled URGENT NEED FOR U.S. CITIZENS RESIDING OUTSIDE THE U.S. TO BE ABLE TO OBTAIN A TAXPAYER IDENTIFICATION NUMBER (“TIN”) OTHER THAN A SOCIAL SECURITY NUMBER are set out below in this section:

The U.S. tax law imposing taxation on the worldwide income of USCs[1] residing overseas has created a dilemma that prejudices these USCs without a SSN. This strict SSN/TIN regulatory rule undermines the basic tax administration system and discourages tax compliance for those USCs who never obtained a SSN. This dilemma affects numerous USCs throughout the world, which is now compounded by the certification and reporting requirements of USCs and third parties, such as FFIs and NFFEs[ under the Foreign Account Tax Compliance Act (“FATCA”).

In short, USCs without a SSN, necessarily cannot be in compliance with U.S. federal tax law. As I point out in my paper, such –

“A law that cannot be complied with is surely a bad law, the same as a “ . . .law that cannot be enforced is a bad law.”[a]

[a] See, The Case Against Taxing Citizens, Reuven S. Avi-Yonah (March 31, 2010), University of Michigan School of Law, Law & Economics Working Papers.

The paper referenced above explains how difficult it is for USCs residing overseas to ever obtain a SSN. Specifically, it explains how difficult it is to have an in-person interview at only 18 different locations around the world with a U.S. Department of State employee. See, 12 Year Old (and Older) U.S. Citizens Residing Outside the U.S. Must Have An “In-Person” Interview in a U.S. Embassy or Consulate for SSN Application in 1 of Just 17 Posts Worldwide

As a USC residing somewhere around the world, you might decide to simply spend the time, money and resources to travel internationally to arrive in the U.S. to apply for a SSN directly with the Social Security Administration within the U.S. Unfortunately, any USC is now legally prohibited from traveling in or out of the U.S. without a U.S. passport. There are few exceptions to this general rule, none of which contemplate U.S. federal tax compliance. See, the relevant excerpts from the white paper:

C. Travel to the U.S. is Also Not An Option for a USC without a SSN, Due to 22 CFR § 53.1 Requiring a U.S. Passport

A possible solution to this TIN/SSN dilemma may appear to be a trip to the U.S. by the USC to apply for a SSN in the U.S. Unfortunately, this simply creates another dilemma, since the USC must have a U.S. passport to travel to the U.S. The immigration law regulations 22 CFR § 53.1 require that a U.S. citizen have a U.S. passport to enter or depart the United States. The relevant part of the regulations is § 53.1(a) which provides as follows:

Passport requirement; definitions.

(a) It is unlawful for a citizen of the United States, unless excepted under 22 CFR 53.2,[2] to enter or depart, or attempt to enter or depart, the United States, without a valid U.S. passport.

These regulations were first published in 2006 and unfortunately, simply create another dilemma for the USC residing overseas without a SSN. This additional dilemma is that an application[3] for a U.S. passport requires the individual have a SSN; a vicious circle back to the inability to obtain a SSN.

At the end of the day, the restrictions imposed on USCs make it legally impossible for a USC without a passport to travel to the U.S. (even if they wish they could) to obtain a SSN.

[1] See, IRC § 61 and Treas. Reg. §§ 1.1?1(b) and 1.1?1(a)(1)..

[2] The exceptions set forth in this regulation would not generally be applicable in the case of USCs residing overseas without a SSN.

[3] Application for a U.S. Passport – http://www.state.gov/documents/organization/212239.pdf.

This entry was posted in Certification Requirement of Section 877(a)(2)(C), FATCA - Chapter 4, Immigration Law Considerations, Social Security - Non-Tax Considerations, Tax Compliance and tagged passports and SSNs, social security number and U.S. citizens, SSN, taxpayer identificaton number.

12 Year Old (and Older) U.S. Citizens Residing Outside the U.S. Must Have An “In-Person” Interview in a U.S. Embassy or Consulate for SSN Application in 1 of Just 17 Posts Worldwide

As previous posts have mentioned, U.S. citizens (USCs) residing overseas can only comply with U.S. tax law and FATCA certifications if they have a social security number (SSN). See, U.S. Citizens Overseas who Wish to Renounce without a Social Security Number will Necessarily be a “Covered Expatriate”

See key excerpts of the paper titled URGENT NEED FOR U.S. CITIZENS RESIDING OUTSIDE THE U.S. TO BE ABLE TO OBTAIN A TAXPAYER IDENTIFICATION NUMBER (“TIN”) OTHER THAN A SOCIAL SECURITY NUMBER that explains this dilemma:

This dilemma affects numerous USCs throughout the world, which is now compounded by the certification and reporting requirements of USCs and third parties, such as FFIs and NFFEs[2] under the Foreign Account Tax Compliance Act (“FATCA”).

* * *

The regulations provide the specific rule that all USCs must have a SSN[1] as their TIN. There are no general exceptions in the regulations to the requirement that a USC must have a SSN as their TIN.

This regulatory requirement specifically directs the USC to the forms that must be completed and filed with the SSA, in order to obtain a SSN, as follows:[2]

(1) Social security number. Any individual required to furnish a social security number pursuant to paragraph (b) of this section shall apply for one, if he has not done so previously, on Form SS-5, which may be obtained from any Social Security Administration or Internal Revenue Service office. He shall make such application far enough in advance of the first required use of such number to permit issuance of the number in time for compliance with such requirement. The form, together with any supplementary statement, shall be prepared and filed in accordance with the form, instructions, and regulations applicable thereto, and shall set forth fully and clearly the data therein called for. Individuals who are ineligible for or do not wish to participate in the benefits of the social security program shall nevertheless obtain a social security number if they are required to furnish such a number pursuant to paragraph (b) of this section. [emphasis added]

These Title 26 regulations discuss individuals requesting forms from “any Social Security Administration or Internal Revenue Service office” which clearly implies that the SSA and the IRS have offices overseas.

Unfortunately, this is not the case, as the IRS recently announced it is closing its full-time walk-in offices in London, Frankfurt and Paris, as the office in Beijing, China was closed in 2014.[3] Similarly, the SSA has no overseas offices, but does have limited field office operations in Canada, the British Virgin Islands and Samoa.[4]

Therefore, it is clear that the above regulations are speaking to individuals who reside and live in the U.S., and not USCs residing overseas when it requires USCs to “ . . . make such application far enough in advance of the first required use of such number to permit issuance of the number in time for compliance with such requirement. [5]

These Title 26 regulations require the application be made well in advance of any tax filing requirements are not realistic for USCs residing overseas as is explained herein. This author has seen the issuance of SSNs take more than 6 months, even when the USC could have an interview in their country of residence.

More importantly, there are very few countries (only 17) where in-person interviews can even be held. See, discussion below.

USCs who have lived most, if not all of their lives outside the U.S., commonly do not have a SSN. The procedural requirements imposed by the SSA to obtain a SSN in these cases are complicated and unrealistic for USCs living overseas.[6] This author has seen cases where USCs residing overseas have even spent the money and resources and time to travel to the U.S. to apply for a SSN, yet were turned away by the SSA, due to various procedural requirements which were not satisfied.

Often times obtaining a SSN overseas is nearly impossible, depending upon which country and where within that country the USC resides.

A. Obtaining a SSN Outside the US by a USC – Much More than Just Filing SSA Form SS-5

The SSA does not have offices outside the U.S. although they have a so-called “Office of International Operations.”[7] The focus of OIO is the administration of social security benefits, not obtaining SSNs for USCs residing overseas. Since the SSA is assisted by the U.S. Department of State (who are not SSN experts), USCs have to rely upon various U.S. embassies and consulate offices around the world, as they try to obtain a SSN.

B. Tax Return Filing Requirements – Minimum Gross Income

Any USC individual is obligated under the U.S. federal tax law to file a federal income tax return IRS Form 1040 if they meet minimum thresholds of income. For the tax year 2015, the thresholds are low, and are reached once the gross income is at least the sum of (i) the “exemption” amount (currently $4,000) and (ii) the “standard deduction” amount (currently $6,300 for single and married filing jointly and $12,600 for married couples filing jointly).[8]

This is true, even if all of the income is earned income and eligible for the foreign earned income exclusion, which is $100,800 for the tax year 2015. [9]

Additionally, USCs living overseas necessarily have a U.S. tax return filing requirement, when they meet these low thresholds of gross income. In these cases, tax returns that are not filed by the 15th of June are not considered timely filed.[10]

II. The Social Security Administration Rules Make it Nearly Impossible for Many USCs Overseas to Reasonably Obtain a SSN

The policy and procedures of the SSA regarding issuing SSNs have changed significantly over the years.[11] The Social Security Administration (SSA) provides a detailed chronology of the major changes in policy and procedures regarding filing for and obtaining a SSN.[12] One of the most significant revisions in the last decade came from The Intelligence Reform and Terrorism Prevention Act of 2004 (P.L. 108-458), which imposes various standards for the verification of documents or records submitted by an individual.

A. Only a Few Countries Around the World have Personnel at U.S. Embassies or Consulate Offices that Can Process SSN Applications – SSA Form SS-5-FS

Applying for SSNs overseas is severely restricted compared to an application in the U.S.

According to the U.S. Department of State, Foreign Affairs Manual (“FAM”), only certain “Claims-Taking Posts” in specific countries “may” include “processing applications for Social Security Numbers.” [13]

These 17 countries (and a city in the case of Jerusalem) with Claims-Taking Posts include:

“Austria, Argentina, Costa Rica, Dominican Republic, France, Germany, Greece, Ireland, Italy, Japan, Jerusalem, Mexico, Norway, Philippines, Poland, Portugal, Spain, and the United Kingdom.”

Noticeably absent are many Western European countries, virtually all of Latin America, virtually all of Asia, virtually all of Eastern Europe, all of the Middle East (except Jerusalem), all of the African continent, all of the Australian continent and surrounding island countries and Russia, among many other significant countries, including OECD member countries.[14]

Nothing in the FAM requires any of these “Claims-Taking Posts” to actually process applications for a SSN. Plus, there are of course hundreds of other countries throughout the world, not listed above, which do not have such a U.S. Department of State Post. For these reasons, USCs in countries such as China must travel to a U.S. Department of State Post (e.g., the Philippines) which is able to process applications for SSNs.

B. In Person Interview Required for Individuals Older than 11 Years Old

Individuals who are older than 11 years old must personally go to the U.S. Embassy or Consulate with a Claims-Taking Post. See 7 FAM 530, pages 7, 12, 13 and 7 FAM EXHIBIT 530(D) Mandatory In-Person Interview Worksheet SSN Applicant Age 12 or Older – Original SSN * * *

All of these rules makes you wonder whether foreign born individuals, such as actress Kim Cattrall from Sex & the City fame would have ever obtained a social security number overseas while she lived in Canada or the UK.

[1] See, Treas. Reg. § 301.6109-1(a)(1)(ii)(A).

[2] See, Treas. Reg. § 301.6109-1(d)(1).

[3] See, Bloomberg article, 14 January 2015 by Kocieniewski, IRS Will Shut Last Overseas Taxpayer-Assistance Centers: “After budget reductions over the last four consecutive years, the IRS is forced to make tough choices during this period of fiscal austerity and these closures have relatively little impact on taxpayers and treaty partners,” said Julianne Breitbeil, an IRS spokeswoman. Also, see IRS website that still reflects the London and Paris offices as open http://www.irs.gov/uac/Contact-My-Local-Office-Internationally.

[4] See, SSA website, Service Around the World, http://www.ssa.gov/foreign/

[5] See, Treas. Reg. § 301.6109-1(d)(1).

[6] See discussion below, regarding requirements to obtain a SSN. I.II, I.I,The Social Security Administration Rules Make it Nearly Impossible for Many USCs Overseas to Reasonably Obtain a SSN

[7] See SSA website, “Office of International Operations” – http://www.ssa.gov/foreign/ “Service Around the World – Welcome to SSA’s Office of International Operations (OIO) home page. The purpose of this site is to assist Social Security customers who are outside the U.S. or planning to leave the U.S. OIO is responsible for administering the Social Security program outside the U.S. and for the implementation of the benefit provisions of international agreements. Since SSA has no offices outside the U.S., OIO is assisted by the Department of State’s embassies and consulates throughout the world.”

[8] See, IR-2014-104, Oct. 30, 2014 and IRS Publication 501.

[9] See, IRC § 911 and IRS Publication 54.

[10] See, Treas. Reg. § 1.6081-5.

[11] See, SSA website, The Story of the Social Security Number, by Carolyn Puckett, Social Security Bulletin, Vol. 69 NO. 2, 2009 (http://ssa.gov/policy/docs/ssb/v69n2/v69n2p55.html.

[12] See, SSA website, Significant Milestones in Social Security Number Policy. A detailed chronology of the major changes in policy and procedures. http://www.ssa.gov/history/ssn/ssnchron.html.

[13] See 7 FAM 530, page 2 of 64.

[14] In contrast to these 17 countries (and one city – Jerusalem) where a USC residing overseas must travel to apply for a SSN, the Treasury Department has announced it has around 100 countries that have signed, or “have reached agreements in substance” a FATCA IGA. USCs throughout the world are required by the Foreign Account Tax Compliance Act (“FACTA”) to provide their U.S. TIN to financial institutions throughout the world (on IRS Form W-9, or its equivalent), which under current law necessarily must be a SSN. Of course, if they have no SSN, they cannot sign IRS Form W-9 which provides in Part II: “Under penalties of perjury, I certify that: 1. The number shown on this form is my correct taxpayer identification number . . .”

[15] See, 7 FAM 534.3 e.

This entry was posted in Famous People, Social Security - Non-Tax Considerations, Tax Compliance and tagged FATCA, in-person interview, social security number and U.S. citizens, SSA Form SS-5, SSN, Tax Return Filing Requirements.

U.S. Citizens Overseas who Wish to Renounce without a Social Security Number will Necessarily be a “Covered Expatriate”

U.S. Citizens Overseas who Wish to Renounce without a Social Security Number (“SSN”) will Necessarily be a “Covered Expatriate”

- The Dilemma of SSNs, TINs and USCs Residing Overseas

The prior post discussed some of the complications of United States Citizens (“USCs”) who reside outside the U.S. and do not have a social security number (“SSN”) . This dilemma exists, even though USCs are not generally required to file for or  obtain a SSN (e.g., at birth – See, SSA Publication – “Social Security Numbers For Children” page 2, It is not obligatory to file for a SSN at birth. “Must my child have a Social Security number? No. Getting a Social Security number for your newborn is voluntary. But, it is a good idea to get a number when your child is born. . . . ).

obtain a SSN (e.g., at birth – See, SSA Publication – “Social Security Numbers For Children” page 2, It is not obligatory to file for a SSN at birth. “Must my child have a Social Security number? No. Getting a Social Security number for your newborn is voluntary. But, it is a good idea to get a number when your child is born. . . . ).

Indeed, it is the U.S. federal tax law that requires the USC must have a SSN for their taxpayer identification number (“TIN”). I will reference various excerpts from a recent paper I drafted and presented titled URGENT NEED FOR U.S. CITIZENS RESIDING OUTSIDE THE U.S. TO BE ABLE TO OBTAIN A TAXPAYER IDENTIFICATION NUMBER (“TIN”) OTHER THAN A SOCIAL SECURITY NUMBER , including the following:

. . . the IRS’ increased focus on international tax compliance has made clear that USCs residing overseas have U.S. tax return filing obligations, even if they have no assets, no income, or no real personal connections in or with the U.S. See IRS notice from 2011 which addresses numerous aspects of tax compliance for USCs overseas, including various penalties under the law[1]:

. . . U.S. Citizens or Dual Citizens Residing Outside the U.S. . . .

The IRS is aware that some taxpayers who are dual citizens of the United States and a foreign country may have failed to timely file United States federal income tax returns or Reports of Foreign Bank and Financial Accounts (FBARs), despite being required to do so. . . . 2. Penalties imposed for failure to file income tax returns or to pay tax . . . 3. Possible additional penalties that may apply in particular cases . . . 6. Possible penalties for failure to file FBAR . . . 7. New reporting requirement for foreign financial assets . . . [emphases added]

USCs residing overseas are subject to the range of tax penalties that apply to all individual taxpayers (e.g., negligence penalties, failure to file penalties, late payment or failure to pay penalties, etc.).[2] Additionally, USCs residing overseas are subject to other, typically much harsher penalties for not timely filing U.S. federal information returns regarding assets located outside the U.S.[3]; alluded to above in the IRS 2011 notice.[4]

These civil penalties typically are a minimum of US$10,000 per statutory violation. USCs who live outside the U.S. necessarily have assets, such as financial accounts in their country of residence. These Title 26 information reporting requirements[5] are referred to herein as “International Information Returns.”

The IRS will not process federal tax returns and International Information Returns without a valid TIN.[6] Plus, the law does not provide for an exception for USCs overseas who do not file returns, if they do not have a SSN. Late filed, or incomplete International Information Returns and tax returns (e.g., lacking a SSN) will typically subject USCs to these penalties even in those cases when the taxpayer has no federal income tax liability.[7]

[1] See, IRS FS-2011-13, December 2011, updated February, 2014.

[2] See, IRS FS-2011-13 and as a sample of some of the many statutory penalties that could typically apply, IRC §§ 6048, 6652(f), 6677, 6654, 6655, 6698, 6699, 6166, 6653, 6675, 6715, 6715A, 6717, 6718, 6719, 6720A, 6725, et. seq.

[3] See, IRC §§ 6038, 6038B, 6038D, 6039F, 6039G, 6046, 6046A, 6048, et. seq.

[4] See, IRS FS-2011-13, December 2011, updated February, 2014.

[5] See, IRC §§ 6038, 6038B, 6038D, 6039F, 6039G, 6046, 6046A, 6048, et. seq.

[6] See, IRS website, “General ITIN Information” – http://www.irs.gov/Individuals/General-ITIN-Information – “IRS no longer accepts, and will not process, forms showing “SSA”, 205c”, “applied for”, “NRA”,& blanks, etc.”

[7] See, IRC §§ 911 (foreign earned income exclusion) and 901 (foreign tax credit), et. seq. A USC residing overseas may have no actual federal income tax liability (for various reasons), typically due to the foreign earned income exclusion and/or foreign tax credit calculation.

The above explains fairly clearly the dilemma facing USCs residing overseas.

The complexity of getting a SSN and the requirements are covered in more detail in the paper. Some key points are:

I. The Social Security Administration Rules Make it Nearly Impossible for Many USCs Overseas to Reasonably Obtain a SSN

The policy and procedures of the SSA regarding issuing SSNs have changed significantly over the years.[1] The Social Security Administration (SSA) provides a detailed chronology of the major changes in policy and procedures  regarding filing for and obtaining a SSN.[2] One of the most significant revisions in the last decade came from The Intelligence Reform and Terrorism Prevention Act of 2004 (P.L. 108-458), which imposes various standards for the verification of documents or records submitted by an individual.

regarding filing for and obtaining a SSN.[2] One of the most significant revisions in the last decade came from The Intelligence Reform and Terrorism Prevention Act of 2004 (P.L. 108-458), which imposes various standards for the verification of documents or records submitted by an individual.

A. Only a Few Countries Around the World have Personnel at U.S. Embassies or Consulate Offices that Can Process SSN Applications – SSA Form SS-5-FS

Applying for SSNs overseas is severely restricted compared to an application in the U.S.

According to the U.S. Department of State, Foreign Affairs Manual (“FAM”), only certain “Claims-Taking Posts” in specific countries “may” include “processing applications for Social Security Numbers.” [3]

These 17 countries (and a city in the case of Jerusalem) with Claims-Taking Posts include:

“Austria, Argentina, Costa Rica, Dominican Republic, France, Germany, Greece, Ireland, Italy, Japan, Jerusalem, Mexico, Norway, Philippines, Poland, Portugal, Spain, and the United Kingdom.”

Noticeably absent are many Western European countries, virtually all of Latin America, virtually all of Asia, virtually all of Eastern Europe, all of the Middle East (except Jerusalem), all of the African continent, all of the Australian continent and surrounding island countries and Russia, among many other significant countries, including OECD member countries.[4]

Nothing in the FAM requires any of these “Claims-Taking Posts” to actually process applications for a SSN. Plus, there are of course hundreds of other countries throughout the world, not listed above, which do not have such a U.S. Department of State Post. For these reasons, USCs in countries such as China must travel to a U.S. Department of State Post (e.g., the Philippines) which is able to process applications for SSNs.

[1] See, SSA website, The Story of the Social Security Number, by Carolyn Puckett, Social Security Bulletin, Vol. 69 NO. 2, 2009 (http://ssa.gov/policy/docs/ssb/v69n2/v69n2p55.html.

[2] See, SSA website, Significant Milestones in Social Security Number Policy. A detailed chronology of the major changes in policy and procedures. http://www.ssa.gov/history/ssn/ssnchron.html.

[3] See 7 FAM 530, page 2 of 64.

[4] In contrast to these 17 countries (and one city – Jerusalem) where a USC residing overseas must travel to apply for a SSN, the Treasury Department has announced it has around 100 countries that have signed, or “have reached agreements in substance” a FATCA IGA. USCs throughout the world are required by the Foreign Account Tax Compliance Act (“FACTA”) to provide their U.S. TIN to financial institutions throughout the world (on IRS Form W-9, or its equivalent), which under current law necessarily must be a SSN. Of course, if they have no SSN, they cannot sign IRS Form W-9 which provides in Part II: “Under penalties of perjury, I certify that: 1. The number shown on this form is my correct taxpayer identification number . . .”

- The Necessary “Covered Expatriate Status” of a USC without a SSN

The core point of this post, with the above SSN background, is to explain how a USC without a SSN will necessarily be a “covered expatriate” since they will not be able to truthfully certify they have complied with the federal tax laws (title 26). See, Certification Requirement of Section 877(a)(2)(C) – (5 Years of Tax Compliance) and Important Timing Considerations per the Statute

As other posts have explained, “covered expatriate” status matters:

See, Why “covered expat” (“covered expatriate”) status matters, even if you have no assets! The “Forever Taint”! (20 May 2014) and The “Hidden Tax” of Expatriation – Section 2801 and its “Forever Taint.” (10 April 2014) and “Covered Expatriate” Status is a “Scarlet Letter” (10 Nov 2014).

If a USC has no SSN, they by definition will never be able to comply with the Certification Requirement of Section 877(a)(2)(C) since they will not be able to comply with IRC § 6109(a) and Treas. Reg. § 301.6109-1. As the SSN/TIN paper explains:

All United States citizens (“USCs”) must have a social security number (“SSN”) under current law as their TIN to file a federal income tax return.[1]

[1] See, IRC § 6109(a) and Treas. Reg. § 301.6109-1.

The IRS will not process federal tax returns and “International Information Returns”, as defined below, without a valid TIN[1]; which currently must be a SSN for a USC.

[1] See, IRS website, – http://www.irs.gov/Individuals/General-ITIN-Information – “IRS no longer accepts, and will not process, forms showing “SSA”, 205c”, “applied for”, “NRA”,& blanks, etc.”

This entry was posted in Certification Requirement of Section 877(a)(2)(C), Social Security - Non-Tax Considerations, Tax Compliance.

Ineligibeility for a SSN after Taking Oath of Renunciation – TINs, ITINs, EINs, etc.

USCs and LPRs residing outside the U.S. have been increasingly renouncing their citizenship and abandoning their lawful permanently residency status, respectively. In some cases, individuals who have lived virtually all (or all) of their lives in a country other than the U.S. are a lmost making a “knee jerk” decision to renounce.

lmost making a “knee jerk” decision to renounce.

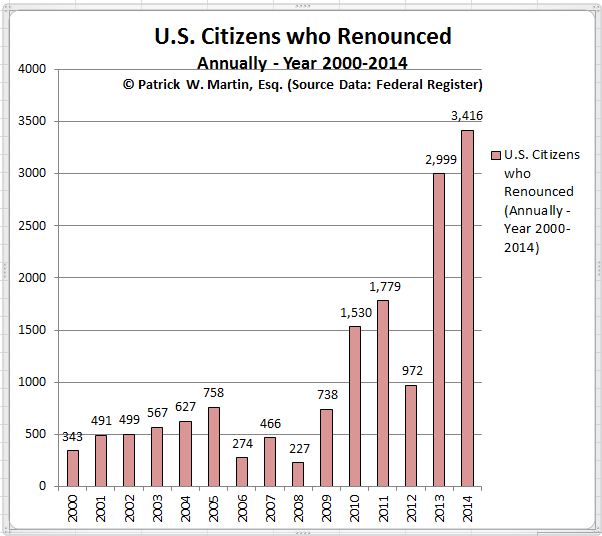

The statistics as to the absolute number and relative increases are astonishing. See, Wow, the number of 2,999 U.S. citizens who renounced in the year 2013 shattered the prior record set in 2011 of 1,782 renunciations. Why so many renunciations?

There is a practical problem for an individual who has renounced his or her U.S. citizenship prior to obtaining a Social Security Number (“SSN”). The individual will NOT be able to obtain a SSN once they have taken the oath of renunciation. See, *Why the Oath of Renunciation is Not the Opposite of the Oath of Allegiance

Of course, as prior posts have explained, an individual must have a “taxpayer identifying number” which must be a SSN for a U.S. citizen. However, the Social Security Administration will not allow an individual who has taken the oath of renunciation to apply for a SSN. See, The Catch 22 of Opening a Bank Account in Your Own Country – for USCs and LPRs

Also, see, Why do I have to get a Social Security Number to file a U.S. income tax return (USCs)?

The only way an individual can avoid becoming a “covered expatriate” is by filing U.S. federal income tax returns and being able to satisfy the certification requirement of Section 877(a)(2)(C). Accordingly, if a SSN is not available, the former citizen will need to file for an ITIN, as explained in previous posts.

This entry was posted in Certification Requirement of Section 877(a)(2)(C), Social Security - Non-Tax Considerations, Tax Compliance.

When does U.S. Law Oblige a Person (if ever) to use a Social Security Number? How does this impact former USCs or LPRs?

When does U.S. Law Oblige a Person (if ever) to use a Social Security Number? How does this impact former USCs or LPRs?

This is an interesting question, which I have done a bit of research on under both the federal tax law (Title 26) and the Social Security Act.

For federal tax purposes, a USC and a LPR must necessarily use their SSN as their U.S. taxpayer identification number. This would generally only be applicable, if they have a tax return filing requirement, or have a U.S. financial account that requires a taxpayer identifying number. See, the regulations that require that a United States citizen use a SSN as his or her taxpayer identifying number (26 CFR 301.6109-1 – Identifying numbers. (a)(1)(ii)(A)):

- (A) Except as otherwise provided in paragraph (a)(1)(ii)(B) and (D) of this section, and § 301.6109-3, an individual required to furnish a taxpayer identifying number must use a social security number.

Since all LPRs and United States citizens are eligible to obtain a social security number, they are therefore required to use the SSN as their U.S. taxpayer identifying number. However, former USCs and LPRs may never have a U.S. tax return filing requirement once they have renounced or abandoned their USC or LPR status, respectively.

The IRS website follows these requirements in its explanation on its website at U.S. Taxpayer Identification Number Requirement

Interestingly, there appears to be no statutory or regulatory rule in the law that allows an individual to somehow “expunge” or otherwise terminate their SSN, once obtained, even after loss of USC or LPR status.

See an earlier post, regarding What happens to your Social Security Number when you shed US citizenship or LPR status?

I cannot find any requirement in the law that obligates a former USC or LPR to use their SSN, other than if they may be required to file a U.S. income tax return (or if they have a U.S. financial or investment account),

This entry was posted in Social Security - Non-Tax Considerations, Social Security Tax Considerations.

What happens to your Social Security Number when you shed US citizenship or LPR status?

The Social Security Act regulations have specific rules regarding social security numbers (“SSNs”). See, specifically § 422.103. Social security numbers.

These regulations, specifically explain a number of rules regarding applying for a SSN, obtaining a replacement social security card (with 10 maximum lifetime replacement cards), how SSNs are assigned, and how the Department of Homeland Security can have an agreement with the Social Security Administration regarding issuance of SSNs for those who have immigrated to the U.S. – See, for instance § 422.103(b)(3)

- (3) Immigration form. SSA may enter into an agreement with the Department of State (DOS) and the Department of Homeland Security to assist SSA by collecting enumeration data as part of the immigration process. Where an agreement is in effect, an alien need not complete a Form SS-5 with SSA and may request, through DOS or Department of Homeland Security, as part of the immigration process, that SSA assign a social security number and issue a social security number card to him/her. Requests for SSNs to be assigned via this process will be made on forms provided by DOS and Department of Homeland Security.

Applications for a SSN are completed through a specific Form S-5, located on the SSA’s website. This Form S-5 discusses the general requirements for a SSN as set forth in the law; i.e., the individual must be either (1) a U.S. citizen, (2) have lawful work authorized immigration status, or a (3) valid non-work reason for requesting a SSN and a card.

Interestingly, there appears to be no statutory or regulatory rule in the law that allows an individual to somehow “expunge” or otherwise terminate their SSN, once obtained, even after loss of USC or LPR status.

This entry was posted in Social Security - Non-Tax Considerations.