Statistics

Form 8854 Filing: TIGTA Report Reveals Compliance Gap

See the “TIGTA Report”. Read it here: More Enforcement and a Centralized Compliance Effort Are Required for Expatriation Provisions

Does TIGTA have the Answer: to the Question – How many former U.S. citizens and long-term lawful permanent residents have filed and should have filed IRS Form 8854?

The short answer to the question above – is NO!

The government does not know how many IRS Forms 8854 should have been filed.

Note the total numbers of 8854 returns filed as reported in Figure 2 of the TIGTA Report were less than 25,000 during a ten year period. This report focuses really only on former U.S. citizens (“USC”) who have renounced their citizenship. Not on lawful permanent residents (“LPRs), which during that same ten year period there were around 200,000 who filed USCIS Form I-407.

* How Many Individuals Should have Filed Form 8854?

“LPR Tax Limbo” – Formal Abandonment of LPR (Form I-407) – BIG GAP with Actual Emigration of LPRs

Millions of lawful permanent residents (LPRs) who have left the U.S. and not “formally abandoned” their LPR status (by filing Form I-407, Record of Abandonment of Lawful Permanent Resident) typically remain in some kind of “LPR U.S. tax limbo.” How many individuals worldwide are in this LPR U.S. tax limbo?

Why are these numbers important for the tax-expatriation analysis? See, a recent post, Why Most LPRs Residing Overseas Haven’t a Clue about the Labyrinth of U.S. Taxation and Bank and Financial Reporting of Worldwide Income and Assets (Part I). Indeed, most individuals probably do not think they are a U.S. federal income tax resident when they leave the U.S. to reside overseas back to their home country. Why would they? There is no tax training manual provided to LPRs who leave the U.S. and no tax advisories – reflected on the card itself (unlike the last page of the U.S. passport, paragraph D). More precisely, most are probably not giving much, if any thought, to the complex U.S. federal tax residency rules and their extraterritorial application.

These individual are typically ill-informed about these rules and mistaken as to how the IRS typically has a different view of their on-going tax obligations. The IRS is increasingly pursuing LPR taxpayers residing outside the U.S. based upon my own anecdotal experience with individual clients and their IRS tax audits. For background information, see, the IRS’s own summary of “. . . Resident Aliens Abroad“. Also, see, Timing Issues for Lawful Permanent Residents (“LPR”) Who Never “Formally Abandoned” Their Green Card and see the IRS practice unit discussion, Determining Tax Residency Status of Lawful Permanent … – IRS.gov

The “big gap” referred to above can be identified from the the Office of Immigration Statistics (OIS) report titled: Estimates of the Lawful Permanent Resident Population in the United States and the Subpopulation Eligible to Naturalize: 2015-2019. According to the report, more than 1 million individuals become LPRs each year. Between naturalization, mortality and emigration the report shows that the LPR population, year over year, has remained stable. In 2019 the total number of LPRs per this report was 13.6 million, up from just 13.0 million in 2015.

The “gap” is the difference between the numbers of LPRs who have left-emigrated the U.S. (some 3+ million) compared to something like an annual average of 15-19 thousand who have filed Form I-407. The gap is in the millions of persons who are in LPR U.S. tax limbo.

The report is also worth reading if you want to understand the demographics of the LPR population. Mexico has about 2.5 million (which is by far the greatest number) of the total 13+ million LPR population.

Out of the total 13.6 million LPRs, there are a total of 9.13 million eligible to become naturalized citizens according to the report (see previous post Why a Naturalized Citizen cannot avoid “Covered Expatriate” status under IRC Section 877A(g)(1)(B)). Some 2.3M, 1.13M and .99M live in California, NY and Texas, respectively as the most LPR populated states.

This report provides only an estimate of “emigration” based upon the government’s research on emigration. See page 5 of the report –

Attrition due to emigration must be estimated because reliable, direct measurements of LPR emigration do not exist.

These estimates are not tied to “formal abandonment” filings of LPR status by filing USCIS Form I-407, Record of Abandonment of Lawful Permanent Resident

As the report points out there is no reliable direct measurements of LPR emigration. They do not exist. This lack of information is what drove me to file a FOIA request with the government to request information about the number USCIS Forms I-407 that are filed with the government. See, also quarterly statistics of the USCIS – Form I-407, Record of Abandonment of Lawful Permanent Resident Status (partial information for years 2016-2019).

The information I obtained in the FOIA response was surprising, since the government had records showing only 46,364 Forms I-407 were filed in the years 2013 through 2015, as follows:

This represents an average of only 15,455 individuals who formally abandoned their LPR status. Contrasted with more than 3.6 million estimated to have emigrated in 2019 per the DHS report leaves a massive gap of well over 3 million persons who held a “green card” and have left. They are now in LPR U.S. tax limbo.

What about the tax consequences? How many of these LPRs who left the U.S. know, understand or have any idea whatsoever of the federal tax filing obligations regarding their status?

What is the takeaway from the DHS report and LPR – I-407 information provided to me by the FOIA response? There is a discrepancy in the millions of people. Millions of individuals who actually leave or have left the U.S. to reside somewhere else around the world; compared to only some tens of thousands of individuals who have formally filed Form I-407, Record of Abandonment of Lawful Permanent Resident.

What can these individuals do to get out of the LPR U.S. tax limbo?

Foreign Government Receives a “FATCA Christmas Gift” from IRS: 1 Gigabyte of U.S. Financial Information

The last post discussed how the director of the Mexican tax administration was critical of the U.S. federal government for not providing FATCA information on U.S. financial accounts. See, Foreign Government Criticizes U.S. Government for  NOT Providing FATCA IGA Information on Their Taxpayers with U.S. Accounts, dated December 14, 2015.

NOT Providing FATCA IGA Information on Their Taxpayers with U.S. Accounts, dated December 14, 2015.

The automatic exchange of bank and financial information is driven by the U.S. Treasury driven Intergovernmental Agreement (IGA).

As a follow-up, the Mexican newspaper Reforma reported on the 17th of December that the U.S. just provided Mexico’s treasury with a gigabyte of Mexican taxpayer information regarding U.S. financial and bank accounts. See, Entrega EU un gigabyte a Hacienda, dated Dec 17, 2015.

This news comes on the heals of the earlier criticism by the Commissioner of the Mexican IRS (SAT – Servicio de  Administración Tributaria (SAT)), Mr. Aristóteles Núñez Sánchez. The Reforma article quotes Óscar Molina Chié (who is in charge of the large taxpayers division at SAT) generously regarding how and what information was provided by the U.S. federal government.

Administración Tributaria (SAT)), Mr. Aristóteles Núñez Sánchez. The Reforma article quotes Óscar Molina Chié (who is in charge of the large taxpayers division at SAT) generously regarding how and what information was provided by the U.S. federal government.

Finally, the article emphasized that Mexico has sent the IRS information regarding Mexican bank accounts of U.S. citizens.

The question is how much Mexican bank and financial information has actually been provided by SAT of the hundreds of thousands (if not more than 1 million) dual national taxpayers, who are citizens of both Mexico and the U.S.? See, Where the IRS will likely look overseas: USCs are Millions Yet U.S. Tax Returns are Just a Few Hundred Thousand, dated January 28, 2015.

WSJ Asks the Question: Is the IRS Undercounting Americans Renouncing U.S. Citizenship?

Is the IRS Undercounting Americans Renouncing U.S. Citizenship?, posted Sept. 16, 2015.

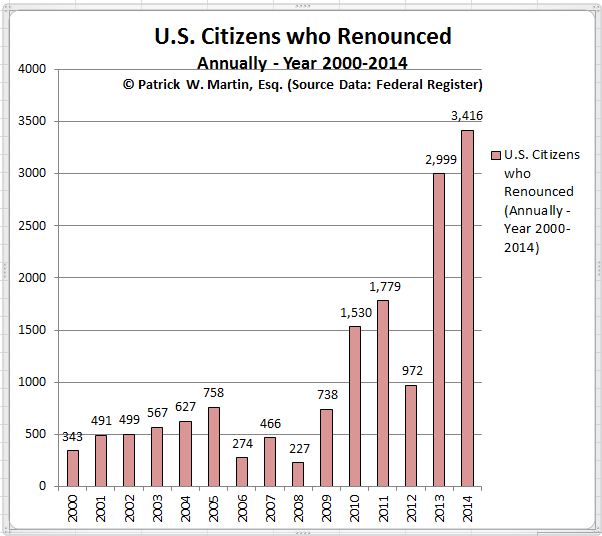

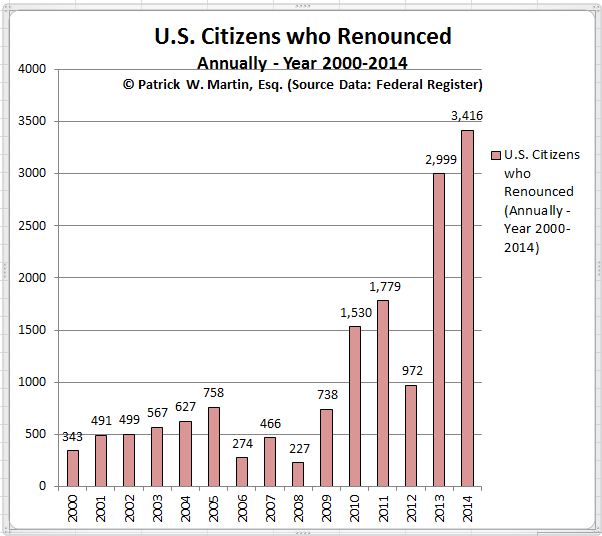

The names of U.S. citizens who have renounced is published quarterly pursuant to IRC Section  6039G. See, prior related posts: 1,426 Individuals Give Up Passport: Record Number of U.S. Citizens Renouncing: Quarter 3 for 2015, October 30, 2015.

6039G. See, prior related posts: 1,426 Individuals Give Up Passport: Record Number of U.S. Citizens Renouncing: Quarter 3 for 2015, October 30, 2015.

No one knows for certain if the IRS (including the IRS per some of my conversations) is getting complete data from the Department of State regarding each name and individual.

The graph I have prepared shows the number of names reported quarterly as I track all reported names quarterly that related to clients and non-clients. The latest cumulative amounts for 2015 (which does not include the 4th quarter) shows 3,221 thus far in the year. If there is close to 1,400 as was the case for the last quarter, the total will be a record – by a bunch; i.e., close to 5,000 renunciations for the year.

Anecdotally, I have seen renunciations surge in our practice, largely as U.S. citizens residing around the world (typically in the “Accidental American” category) learn about the long arm of the U.S. tax law by way of their local financial institutions and reporting and documents requested as part of FATCA. See, Why Most U.S. Citizens Residing Overseas Haven’t a Clue about the Labyrinth of U.S. Taxation and Bank and Financial Reporting of Worldwide Income and Assets, posted Nov. 2, 2015.

None of this answers the question of whether there is under-reporting of the names? Indeed, the question will likely not be answered without more information provided by the U.S. Department of State and the U.S. Treasury (i.e., the IRS officers responsible for issuing the names and report in the Federal Register).

The government is also likely to reject issuing information on these details to individuals and their advisers as part of a Freedom of Information Act (“FOIA”) request. I have had similar requests rejected by the government under the so called “Exemption 7(E)” of FOIA. See,

Will 2015 Be a Record Year for Citizenship Renunciations?

The First Quarter of 2015 saw a large number of published names of former U.S. citizens: 1,335 total for the first quarter.

In addition, the second quarter saw a total of 460, for a  cumulative total for the year (mid way through the year of 1,795). At this pace, the year 2015 could be a slight record of U.S. citizenship renunciations compared to the record year of 2014.

cumulative total for the year (mid way through the year of 1,795). At this pace, the year 2015 could be a slight record of U.S. citizenship renunciations compared to the record year of 2014.

See, New Record of U.S. Citizens Renouncing – The New Normal

The names of each citizen can be located in the list published in the Federal Register.

There are a number of key considerations and strategic decisions that most all U.S. citizens need to consider prior to renouncing citizenship. See, for instance –

The “Hidden Tax” of Expatriation – Section 2801 and its “Forever Taint.”

Can the U.S. Federal Government Bar Entry into the U.S. to a U.S. Citizen without a U.S. Passport?

Global Entry, SENTRI and NEXUS after Renouncing – the “Trusted Traveler Programs” – SAFE TRAVELS!

Does the IRS have access to the USCIS immigration data for former lawful permanent residents (LPRs)?

Information about former LPRs, such as the individuals names, is not published under the statute, IRC Section 6039G, which only covers former U.S. citizens.

This raises the question of whether the Department of Homeland Security tracks former LPRs – names and addresses overseas and provides that information to the Internal Revenue Service?

A prior post discussed the newly published USCIS immigration form I-407 for LPRs who must now use it when formally abandoning LPR status. See, More Information and More Information: USCIS Creates New Form for Abandonment of Lawful Permanent Residency

The new I-407 Form requires much more information and is 2 pages in length. The old form had only 6 lines and was less than 1/2 of a page in length. These forms  are set forth here. The new form requires the address overseas of the individual.

are set forth here. The new form requires the address overseas of the individual.

As readers here know, the names of former U.S. citizens are published quarterly by the U.S. federal government for the world to see. See a prior post, The 2014 Third Quarter Renunciations Is probably the New Norm –

The complete set of lists going back to the mid-1990s can be reviewed here. Quarterly Publications.

Of course, the IRS can easily select and identify individuals for audit, by simply drawing from the published names of former U.S. citizens, which is currently tracking at an average of about 850 former USCs quarterly. In contrast, the number of former LPRs who have filed USCIS Form I-407 is tracking at an average of about 4,000 to 5,000 individuals quarterly.

While citizens are often the focus of the public press and Congress regarding “expatriation taxation”; the statute also wraps in so-called “long-term residents.” These are individuals who had or continue to have “lawful permanent residency status.” There are numerous technical considerations in this area, but needless to say, the number of former lawful permanent residents who have simply filed Form I-407 – Abandonment is far in excess of those U.S. citizens who have filed for and received a Certificate of Loss of Nationality (“CLN”) – Form DS-4083 (CLN). The graph reflects the enormous difference.

See, earlier post The Number of LPRs “Leaving” the U.S. is 16X Greater than the Number of U.S. Citizens Renouncing Citizenship

On a related post, the question was raised –What are the Number of LPRs who Leave U.S. Annually without filing Form I-407 – Abandonment?

This is important, since many LPR individuals will have “expatriated” without actually having filed USCIS Form I-407. See, Oops…Did I “Expatriate” and Never Know It: Lawful Permanent Residents Beware! International Tax Journal, CCH Wolters Kluwer, Jan.-Feb. 2014, Vol. 40 Issue 1, p9

While the IRS has specific information about U.S. citizens, it is not clear whether the Department of Homeland Security via the USCIS provides data to the IRS regarding lawful permanent residents who have filed Form I-407? If such an individual becomes a “covered expatriate” under the U.S. tax law, the range of adverse tax consequences can follow them and their future beneficiaries and heirs, including as follows:

- “mark to market” taxation on their worldwide assets,

- 40% inheritance tax to U.S. beneficiaries,

- 40% tax on gifts to U.S. beneficiaries,

- etc.

It seems fairly easy, from a legal perspective, that the IRS can request the names, addresses (and indeed the newly completed form) from the USCIS of all individuals who have filed USCIS Form I-407. From the USCIS records, the IRS will be able to determine if the individual was a “long term resident” based upon the number of years the individual had such status.

Assuming the IRS determines the individual is a long term resident, they can then simply check to see if the they have received IRS Form 8854 from the former LPR; in order to determine if she or he satisfied the certification requirement of Section 877(a)(2)(C). If not, the IRS will necessarily know the individual is a “covered expatriate.”

Laura Saunders of the WSJ: “Record Number Gave Up U.S. Citizenship or Long-Term Residency in 2014”

Record Number Gave Up U.S. Citizenship or Long-Term Residency in 2014: WSJ: By, Laura Saunders (10 Feb. 2015)

*

Her most recent article has a number of excellent observations, including the following regarding an academic study of those citizens living abroad:

According to a recent survey of 1,546 U.S. citizens and former citizens living abroad, 31% of participants have actively considered renouncing their U.S. citizenship and 3% are in the process of doing so. Many who were considering the move cited increasingly onerous and intrusive financial reporting requirements. The survey was conducted between Dec. 5 and Jan. 20 by Amanda Klekowski von Koppenfels, a researcher at the University of Kent in the U.K.

For other articles written by Ms. Laura Saunders, on this related subject, see the Media: News & Articles section –

Wall Street Journal: Expats Left Frustrated as Banks Cut Services Abroad Americans Overseas Struggle With Implications of Crackdown on Money Laundering and Tax Evasion, (The Wall Street Journal, 11 Sept 2014) By –Laura Saunders

IRS Eases Up on Accidental Tax Cheats: Agency Lowers Some Offshore-Account Penalties, Raises Others (The Wall Street Journal, June 18, 2014), By – Liam Pleven and Laura Saunders

The Number of Citizens Leaving (Renouncing) Versus Coming (Naturalizing) is Just a Speck

Much has been made about the number of citizens who have been renouncing their U.S. citizenship over the last few years. In historical terms, it is a relative explosion. See, earlier post – The 2014 Third Quarter Renunciations Is probably the New Norm –

However, compared to the

number of lawful permanent residents (LPR) who are leaving the U.S., the number is relatively small. See, earlier post The Number of LPRs “Leaving” the U.S. is 16X Greater than the Number of U.S. Citizens Renouncing Citizenship

number of lawful permanent residents (LPR) who are leaving the U.S., the number is relatively small. See, earlier post The Number of LPRs “Leaving” the U.S. is 16X Greater than the Number of U.S. Citizens Renouncing Citizenship

On a related post, the question was raised –What are the Number of LPRs who Leave U.S. Annually without filing Form I-407 – Abandonment?

However, the number of individuals who wish to come to the U.S. to become citizens is far in excess of the number who are renouncing their citizenship.  According to the USCIS, there are about 700,000 individuals annually who become naturalized citizens. In the year 2008, there were more than 1 million naturalized citizens. See table:

According to the USCIS, there are about 700,000 individuals annually who become naturalized citizens. In the year 2008, there were more than 1 million naturalized citizens. See table:

Compare these numbers to just about 3,000 annually of individual who are renouncing their citizenship.

Of course, everyone has their own story and reasons for either coming or going, but in relative terms, those who find it desirous to renounce citizenship (at least in absolute numbers and relative terms) represent a small speck (less than 1/2 of 1 percent), compared to those who are becoming naturalized citizens.

Finally, for anyone who wishes to become a naturalized citizen, they must be aware they cannot “reverse” the decision without having potentially adverse U.S. tax consequences. See, Why a Naturalized Citizen cannot avoid “Covered Expatriate” status under IRC Section 877A(g)(1)(B)

What are the Number of LPRs who Leave U.S. Annually without filing Form I-407 – Abandonment?

A prior post identified the number of lawful permanent residents (LPRs) who file Form I-407 to formally abandon their lawful permanent residency. See, The Number of LPRs “Leaving” the U.S. is 16X Greater than the Number of U.S. Citizens Renouncing Citizenship

These numbers of I-407 forms filed annually were obtained through a freedom of Information Act (“FOIA”) request and provided by the USCIS. See tabl:

Of course, this statistic does NOT identify the number of the approximate 13.3+ million LPRs who leave the U.S. to live elsewhere in another country without completing Form I-407 and formally abandoning. The estimated number of LPRs was 13.3 million for the year 2012 as reported by the Office of Statistics of the DHS. See, Estimates of the Legal Permanent Resident Population in 2012.

Maybe the number of individuals who fall into this latter category (i.e., moving out of the U.S. without filing Form I-407) is several hundred of thousands of individuals annually?

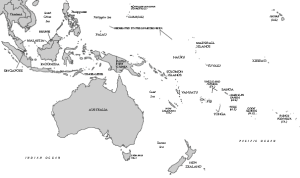

Importantly, from a taxation perspective, anyone who moves and lives in a country with a U.S. income tax treaty (the list of these countries is set out below – from the IRS website), needs to be careful not to be deemed to be a “covered expatriate” due to the application of IRS Form 7701(b)(6). See, IRS Notice 2009-85.

See, the following posts with further explanation of the tax law for LPRs who move and live in one of the countries listed below. Countries with U.S. Income Tax Treaties & Lawful Permanent Residents (“Oops – Did I Expatriate”?)

See also, Who is a “long-term” lawful permanent resident (“LPR”) and why does it matter?

Becoming a “covered expatriate” has U.S. tax consequences not just to the “former long-term LPR”, but also to their family and friends who are “U.S. persons” (as defined under Section 7701. See, The “Hidden Tax” of Expatriation – Section 2801 and its “Forever Taint.”

A

Armenia

Australia

Austria

Azerbaijan

B

Bangladesh

Barbados

Belarus

Belgium

Bulgaria

C

Canada

China

Cyprus

Czech Republic

D

E

F

G

H

I

Iceland

India

Indonesia

Ireland

Israel

Italy

J

K

L

M

N

Netherlands

New Zealand

Norway

O

P

Pakistan

Philippines

Poland

Portugal

Q

R

S

Slovak Republic

Slovenia

South Africa

Spain

Sri Lanka

Sweden

Switzerland

T

Tajikistan

Thailand

Trinidad

Tunisia

Turkey

Turkmenistan

U

Ukraine

Union of Soviet Socialist Republics (USSR)

United Kingdom

United States Model

Uzbekistan

V