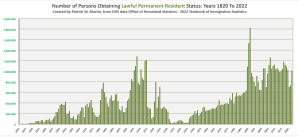

There were more LPRs admitted, in absolute terms in 1905 (1,026,499) than in 2022 (1,018,349).

[arm_restrict_content plan=”2,” type=”show”]

In percentage terms the total number of LPRs in 1905 compared to the total population was more than four times (4X) greater than in 2022 when it was (about 3/10th of 1 percent or 0.306%; versus a total population of 333 million) . In 1905 the total population was about 84 million, with newly admitted LPRs representing 1.225 percent of the entire resident population (1.225%; is greater than 4X the 2022 relative percentage).

- The “Mark to Market” Tax that did NOT Exist in 1820, 1913, 1966 (Not Until 1996)

The US tax expatriation laws now impose a “mark to market” tax on so-called “long-term residents” who become “covered expatriates.” Such a concept in the tax law never existed in the early part of the 20th century, and indeed only became law in 1996. See an earlier post, The Foreign Investors Tax Act of 1966 (“FITA”) – The Origin of US Tax Expatriation law

This so-called Mark to Market tax is based upon a legal fiction, as if the individuals sold their worldwide assets on the “expatriation date.” It applies, even though there’s no current sale of assets, no disposition, transfer, change of ownership, change of title, or other “realization” event. The term “realization” is very significant in US tax law, including as recently discussed by the United States Supreme Court. See below and Moore v. the United States (2024) .

Below is a table of LPRs who were admitted to that status, per year, over the last 200+ years starting in 1820:

Are you or any of your family members one of these millions (more than 88 million) of LPR individuals represented in the above graph over the last 200+ years?

An increasing number of international tax scholars and practitioners are questioning the validity of this “mark to market” tax in light of recent US Supreme Court (SCOTUS) case law. See a recent post, Is the “Mark to Market” Expatriation Tax Unconstitutional? – through the Prism of Moore