Tax Considerations for Immigration

Part I of Part II: The Gold Card – “It’s like the green card, but better and more sophisticated.”

Will the “gold card” sell to ultra high net worth investors around the world who want U.S. citizenship (“USC”)? What are the tax costs of USC? * About the Author: Patrick W. Martin

President Trump again announced on April 3, aboard Air Force One his plan:

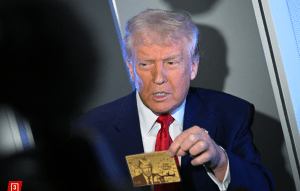

See, the New York Post – Trump unveils $5 million ‘gold card’ for rich migrants emblazoned with his image

Whether the U.S. adopts a new “Gold Card” “For $5 million [that] we will allow the most successful job-creating people from all over the world to buy a path to U.S. citizenship,” is up to the U.S. government.

* Congressional Powers: Article I, Section 1, and Article I, Section 8 of the U.S. Constitution.

Congress can amend Title 8 and include a new “Gold Card” option.

Current law provides the EB-5 visa as one path towards a “green card” that ultimately can lead to U.S. citizenship through naturalization.

President Trump presented at his March 4th speech to a joint session of Congress, explaining the concept: “It’s like the green card, but better and more sophisticated. And these people will have to pay tax in our country.”

* Reducing the Deficit: $1.31 trillion more than Gov’t has collected in fiscal year (FY) 2025

Sounds like a panacea to help the U.S. federal deficit problem? If 100,000 of these “Gold Cards” were sold for $5M each, and these funds were paid directly over to the federal government, that would raise $500 billion dollars. If 1 million were sold, that would be $5 trillion dollars to use to pay down the deficit (running annually at far greater than $1 trillion dollars since 2019).

To put that into perspective, the EB-5 visa that also leads to a “green card” that can further lead to U.S. citizenship through naturalization has an annual visa limit of about 10,000. See, USCIS’s article – (16 Aug 2024) – Annual Limit Reached in the EB-5 Unreserved Category There have been multiple years where the annual visa limit was not met. Prior to 2015, the 10,000 visa limit was never met and in several years there were less than 500 EB-5 visas issued annually.

- EB-5 visa – Leading to a Green Card

There have been less than 150,000 EB-5 visas issued over the last 35 years since its adoption in 1990. Is it realistic to be able to “sell” even ten thousand $5M gold visas annually, when the “green EB-5 visa” costs $800,000 and has had less than 150,000 issued in nearly 35 years?

Plus, see the U.S. Department of State’s Immigrant Visa Statistics, including the – Annual Numerical Limits for Fiscal Year 2025 for more details about the EB-5 visa program statistics.

-

- Equity Investment for EB-5 visa – $800,000 (Does NOT go to the Government)

The total required equity investment amount for an EB-5 visa in the qualifying project, is only $800,000 (if in a “TEA”). See, EB-5 Immigrant Investor Program, as published by the U.S. Citizenship and Immigration Services (USCIS). See, USCIS’s Chapter 2 – Immigrant Petition Eligibility Requirements. It used to be only $500,000 (1/10th of $5M). A TEA is a targeted employment area (“TEA”) that meets specific requirements under the law. If the capital investment is not in a TEA, the required minimal capital investment amount is $1,050,000 that increases in January 1, 2027 and each 5 years thereafter. Still about 1/5th the cost of a “gold visa”.

- U.S. Estate and Gift Tax Consequences for U.S. Citizens and those with a Green Card (“Gold Card”?)

Finally, maybe the biggest impact on who wants an investor visa that leads to U.S. citizenship depends largely upon the U.S. income tax and U.S. estate and gift tax consequences. There are many tax implications. See, my case Aroeste v United States – Order Nov 2023, that was appealed to the 9th Circuit by the Office of Solicitor General (DOJ). U.S. District Court ruled in favor of green card holder.

Ultra high net worth individuals around the world want to know the tax costs of U.S. citizenship. Importantly, new regulations were issued in January 2025 regarding the tax consequences of  renouncing USC and triggering the U.S. “expatriation tax” that is the primary focus of these materials. See, these regulations – here: Guidance Under Section 2801 Regarding the Imposition of Tax on Certain Gifts and Bequests From Covered Expatriates

renouncing USC and triggering the U.S. “expatriation tax” that is the primary focus of these materials. See, these regulations – here: Guidance Under Section 2801 Regarding the Imposition of Tax on Certain Gifts and Bequests From Covered Expatriates

These tax consequences of the “gold visa” will be explored in more detail in Part II.

For a more detailed discussion of tax issues tied to pre-immigration to the U.S., see my chapter of the tax implications of immigration to the U.S. (as opposed to emigration from it). I wrote the tax chapter in the latest edition of the American Immigration Lawyers Association (“AILA’s) – Immigration Options for Investors & Entrepreneurs (out of print) titled Key U.S. Tax Considerations for Investor Visa Applicants by Patrick W. Martin.