Revocation or Denial of U.S. Passports

Did USCs Born in the U.S. lately (not to USC Parents) – Accidentally “Expatriate” for U.S. Tax Purposes? – per President Trump issued Executive Order (EO) 14160

The United States has respected citizenship for those born on U.S. soil, since the U.S. Supreme Court ruled on the issue back in 1898 in United States v. Wong Kim Ark. We know that notwithstanding stare decisis, SCOTUS sometimes overturns its prior precedent. See, Loper Bright Enterprises v. Raimondo (2024) overturning Chevron U.S.A. Inc. v. Natural Resources Defense Council (1984); Dobbs v. Jackson Women’s Health Organization (2022), overturing Roe v. Wade (1973); and Brown v. Board of Education (1954) overturning Plessy v. Ferguson (1896).

- President’s Executive Order 14160: Titled, Protecting the Meaning and Value of American Citizenship

It provides in relevant part:

Sec. 2. Policy. (a) It is the policy of the United States that no department or agency of the United States government shall issue documents recognizing United States citizenship, or accept documents issued by State, local, or other governments or authorities purporting to recognize United States citizenship, to persons: (1) when that person’s mother was unlawfully present in the United States and the person’s father was not a United States citizen or lawful permanent resident at the time of said person’s birth, or (2) when that person’s mother’s presence in the United States was lawful but temporary, and the person’s father was not a United States citizen or lawful permanent resident at the time of said person’s birth.

(b) Subsection (a) of this section shall apply only to persons who are born within the United States after 30 days from the date of this order.

- SCOTUS Announced it Will Hear Arguments on May 15, 2025

See, SCOTUS order – here, and repo rted here: Birthright citizenship cases to be heard at the Supreme Court in May

rted here: Birthright citizenship cases to be heard at the Supreme Court in May

The Congressional Research Service has an excellent summary article it prepared in 2018, titled – The Citizenship Clause and “Birthright Citizenship”: A Brief Legal Overview (1 Nov. 2018). This report was drafted when President Trump during his first term questioned the validity of “birthright citizenship”. Below is an excerpt from that 2018 article, relevant to the:

Under federal law, nearly all people born in the United States become citizens at birth. This rule is known as “birthright citizenship,” and it derives from both the Constitution and complementary statutes and regulations. The Citizenship Clause of the Fourteenth Amendment states that “[a]ll persons born or naturalized in the United States, and subject to the jurisdiction thereof, are citizens of the United States and of the State wherein they reside.” The Immigration and Nationality Act (INA), in turn, declares certain persons to be U.S. citizens and nationals at birth. INA § 301(a) more or less tracks the Citizenship Clause in stating that “a person born in the United States, and subject to the jurisdiction thereof” is a “national[] and citizen[] of the United States at birth.” (The INA also extends citizenship at birth to various persons not protected by the Citizenship Clause, such as those born abroad to some U.S. citizen parents.) Federal regulations—including those that govern the issuance of passports and access to certain benefits—implement the INA by providing that a person is a U.S. citizen if he or she was born in the United States, so long as the parent was not a “foreign diplomatic officer” at the time of the birth.

persons not protected by the Citizenship Clause, such as those born abroad to some U.S. citizen parents.) Federal regulations—including those that govern the issuance of passports and access to certain benefits—implement the INA by providing that a person is a U.S. citizen if he or she was born in the United States, so long as the parent was not a “foreign diplomatic officer” at the time of the birth.

The report goes on to explain –

The weight of current legal authority suggests that these executive and legislative proposals to restrict birthright citizenship would contravene the Citizenship Clause. At least since the Supreme Court’s decision in the 1898 case United States v. Wong Kim Ark, the prevailing view has been that all persons born in the United States are constitutionally guaranteed citizenship at birth unless their parents are us born individuals foreign diplomats, members of occupying foreign forces, or members of Indian tribes. In Wong Kim Ark, the Court held that a man born in the United States in 1873 to parents who were Chinese nationals acquired citizenship at birth under the Fourteenth Amendment. The parents were ineligible to naturalize under the law of the time, but they had established “permanent domicile and residence in the United States.” The Court reasoned that the Citizenship Clause should be “interpret[ed] in light of the common law” and grounded its holding in the common law principle of jus soli or “right of the soil.” Pursuant to that principle, “every child born in England of alien parents was a natural-born subject, unless the child of an ambassador or other diplomatic agent of a foreign state, or of an alien enemy in hostile occupation of the place where the child was born.”

soil.” Pursuant to that principle, “every child born in England of alien parents was a natural-born subject, unless the child of an ambassador or other diplomatic agent of a foreign state, or of an alien enemy in hostile occupation of the place where the child was born.”

- Tax Expatriation Consequences –

As to “tax expatriation” – of these individuals? I suspect these babies (i.e., those born after 30 days from the executive order; on or after February 19, 2025) will have bigger issues to worry about other than their U.S. tax issues if SCOTUS rules against them.

Did USCs Born in the U.S. (not to USC Parents) – Accidentally “Expatriate” for U.S. Tax Purposes? – per President Trump issued Executive Order (EO) 14160

Part I of Part II: The Gold Card – “It’s like the green card, but better and more sophisticated.”

Will the “gold card” sell to ultra high net worth investors around the world who want U.S. citizenship (“USC”)? What are the tax costs of USC? * About the Author: Patrick W. Martin

President Trump again announced on April 3, aboard Air Force One his plan:

See, the New York Post – Trump unveils $5 million ‘gold card’ for rich migrants emblazoned with his image

Whether the U.S. adopts a new “Gold Card” “For $5 million [that] we will allow the most successful job-creating people from all over the world to buy a path to U.S. citizenship,” is up to the U.S. government.

* Congressional Powers: Article I, Section 1, and Article I, Section 8 of the U.S. Constitution.

Congress can amend Title 8 and include a new “Gold Card” option.

Current law provides the EB-5 visa as one path towards a “green card” that ultimately can lead to U.S. citizenship through naturalization.

President Trump presented at his March 4th speech to a joint session of Congress, explaining the concept: “It’s like the green card, but better and more sophisticated. And these people will have to pay tax in our country.”

* Reducing the Deficit: $1.31 trillion more than Gov’t has collected in fiscal year (FY) 2025

Sounds like a panacea to help the U.S. federal deficit problem? If 100,000 of these “Gold Cards” were sold for $5M each, and these funds were paid directly over to the federal government, that would raise $500 billion dollars. If 1 million were sold, that would be $5 trillion dollars to use to pay down the deficit (running annually at far greater than $1 trillion dollars since 2019).

To put that into perspective, the EB-5 visa that also leads to a “green card” that can further lead to U.S. citizenship through naturalization has an annual visa limit of about 10,000. See, USCIS’s article – (16 Aug 2024) – Annual Limit Reached in the EB-5 Unreserved Category There have been multiple years where the annual visa limit was not met. Prior to 2015, the 10,000 visa limit was never met and in several years there were less than 500 EB-5 visas issued annually.

- EB-5 visa – Leading to a Green Card

There have been less than 150,000 EB-5 visas issued over the last 35 years since its adoption in 1990. Is it realistic to be able to “sell” even ten thousand $5M gold visas annually, when the “green EB-5 visa” costs $800,000 and has had less than 150,000 issued in nearly 35 years?

Plus, see the U.S. Department of State’s Immigrant Visa Statistics, including the – Annual Numerical Limits for Fiscal Year 2025 for more details about the EB-5 visa program statistics.

-

- Equity Investment for EB-5 visa – $800,000 (Does NOT go to the Government)

The total required equity investment amount for an EB-5 visa in the qualifying project, is only $800,000 (if in a “TEA”). See, EB-5 Immigrant Investor Program, as published by the U.S. Citizenship and Immigration Services (USCIS). See, USCIS’s Chapter 2 – Immigrant Petition Eligibility Requirements. It used to be only $500,000 (1/10th of $5M). A TEA is a targeted employment area (“TEA”) that meets specific requirements under the law. If the capital investment is not in a TEA, the required minimal capital investment amount is $1,050,000 that increases in January 1, 2027 and each 5 years thereafter. Still about 1/5th the cost of a “gold visa”.

- U.S. Estate and Gift Tax Consequences for U.S. Citizens and those with a Green Card (“Gold Card”?)

Finally, maybe the biggest impact on who wants an investor visa that leads to U.S. citizenship depends largely upon the U.S. income tax and U.S. estate and gift tax consequences. There are many tax implications. See, my case Aroeste v United States – Order Nov 2023, that was appealed to the 9th Circuit by the Office of Solicitor General (DOJ). U.S. District Court ruled in favor of green card holder.

Ultra high net worth individuals around the world want to know the tax costs of U.S. citizenship. Importantly, new regulations were issued in January 2025 regarding the tax consequences of  renouncing USC and triggering the U.S. “expatriation tax” that is the primary focus of these materials. See, these regulations – here: Guidance Under Section 2801 Regarding the Imposition of Tax on Certain Gifts and Bequests From Covered Expatriates

renouncing USC and triggering the U.S. “expatriation tax” that is the primary focus of these materials. See, these regulations – here: Guidance Under Section 2801 Regarding the Imposition of Tax on Certain Gifts and Bequests From Covered Expatriates

These tax consequences of the “gold visa” will be explored in more detail in Part II.

For a more detailed discussion of tax issues tied to pre-immigration to the U.S., see my chapter of the tax implications of immigration to the U.S. (as opposed to emigration from it). I wrote the tax chapter in the latest edition of the American Immigration Lawyers Association (“AILA’s) – Immigration Options for Investors & Entrepreneurs (out of print) titled Key U.S. Tax Considerations for Investor Visa Applicants by Patrick W. Martin.

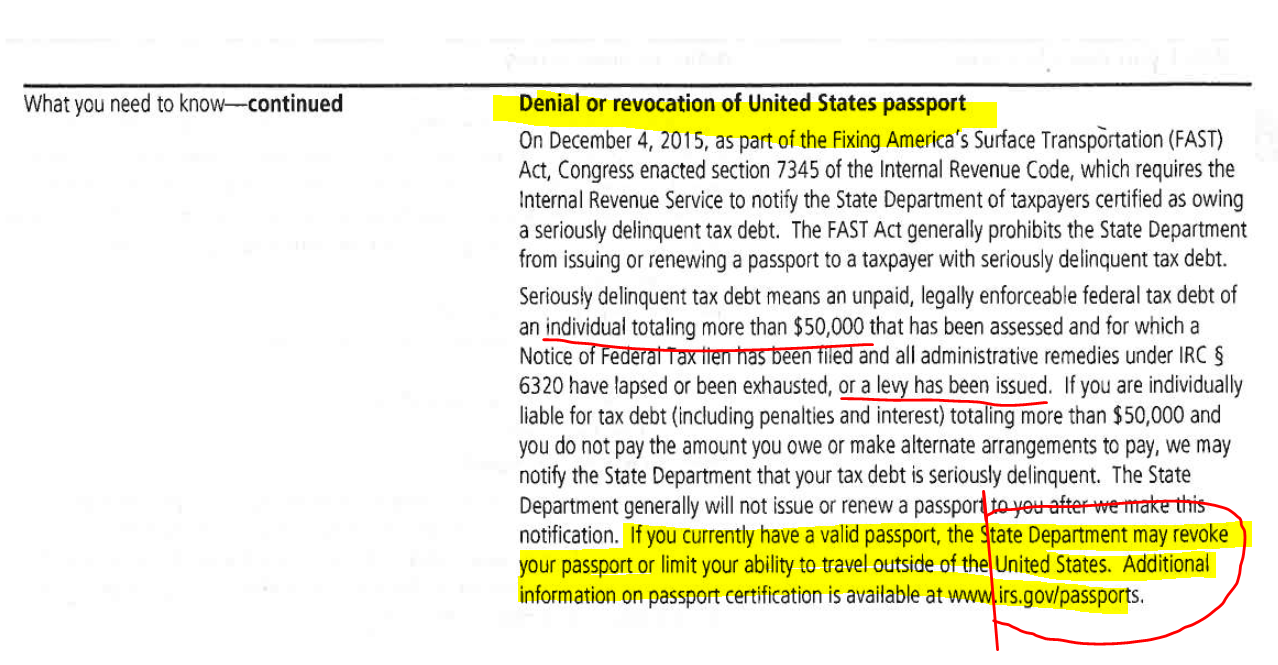

At the time, it was clear that the IRS and the Department of Justice was going to take a substantial amount of time to actually implement what is a major change in the law. In short, the IRS has the power and obligation to notify the Secretary of State to (i) deny a U.S. citizen (the “Taxpayer”) a U.S. passport, or (ii) revoke or not renew a U.S. passport of the Taxpayer. The law is not clear as to what steps the Department of State will necessarily take in response to the notification.

At the time, it was clear that the IRS and the Department of Justice was going to take a substantial amount of time to actually implement what is a major change in the law. In short, the IRS has the power and obligation to notify the Secretary of State to (i) deny a U.S. citizen (the “Taxpayer”) a U.S. passport, or (ii) revoke or not renew a U.S. passport of the Taxpayer. The law is not clear as to what steps the Department of State will necessarily take in response to the notification.

a recent Notice from the IRS to a USC residing outside the U.S.

a recent Notice from the IRS to a USC residing outside the U.S.