Month: January 2024

When do I (as a resident) meet the gross income thresholds that require me to file a U.S. income tax return? Updated for 2023 Income Thresholds

In 2014, this blog explained the income thresholds relevant for filing tax returns during those years. However, the tax reform implemented in 2018, known as the Tax Cuts and Jobs Act (TCJA), brought significant changes to who is required to file tax returns based on income thresholds. So, when exactly do I reach the gross income thresholds that necessitate filing a U.S. income tax return? Old Post (2014)

These thresholds differ significantly from those in 2014 due to the TCJA passed in 2017.

That blog post detailed specific requirements applicable only to U.S. resident individual taxpayers:

Any USC individual (and any LPR who does not live in a country with a U.S. income tax treaty) is obligated under the U.S. federal tax law to file a federal income tax return IRS Form Form 1040 if they meet minimum thresholds of income. The thresholds are low, and are reached once the gross income is at least the sum of (i) the “exemption” amount (currently US$3,900 per exemption) and (ii) the “standard deduction” amount.

Accordingly, even if a USC or LPR has even a modest sum of “gross income”, which equates to at least US$10,000 (in whatever currency earned), the USC or LPR will probably have a U.S. tax return filing requirement.

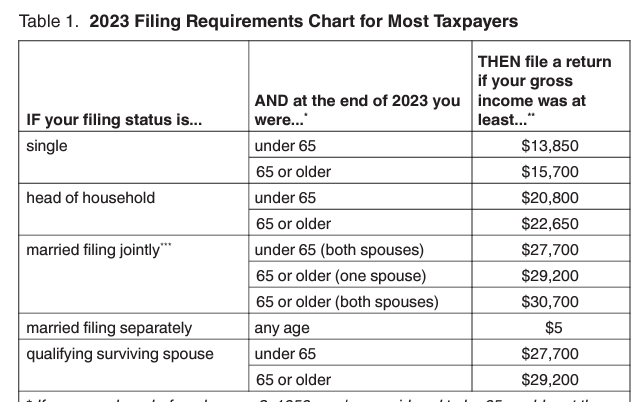

Several significant developments have occurred since the publication of that blog post. First, the federal tax reform primarily applicable for the 2018 tax year, the The 2017 Tax Cuts and Jobs Act (TCJA), substantially altered various tax concepts. Specifically, the TCJA eliminated the concept of “personal exemptions” for the taxpayer, spouse, and dependents. These were previously used to calculate income thresholds determining whether a U.S. resident taxpayer had to file a tax return or not. However, they are no longer applicable. The standard deduction is now key to determine who is required to file.

A recent federal report from Congressional Research Service (CRS Report explains -Nov. 2023): Under the TCJA, basic standard deduction amounts in 2018 were nearly doubled to $12,000 for single filers, $18,000 for head of household filers, and $24,000 for married joint filers. These amounts were annually adjusted for inflation after 2018. In 2024, these amounts are $14,600, $21,900, and $29,200, respectfully.

Hence, for U.S. residents, the filing thresholds have increased substantially for those required to file U.S. tax returns: $14,600 for single filers, $21,900 for head of household filers, and $29,200 for married joint filers for the 2024 tax year.

Non-residents have a completely different rule as to when they are required to file U.S. non-resident tax returns (1040NR), which will be discussed in a later blog. A non-resident can have as little as say US$1,500 of income sourced from the United States and have an obligation to file a tax return. Totally different thresholds and totally different rules are applicable.

Countries From Which Viewers Read Posts – Tax-Expatriation.com – First Week of 2024 (Which Ones are Tax Treaty Countries?) – Applying the “Escape Hatch”

The whole idea of the “escape hatch” for tax treaties is an excellent way of explaining how and when tax treaty law applies in different circumstances. Importantly, the U.S. federal government cannot deny an individual (or presumably a company either) from properly applying the law of a tax treaty – even if they “gave [an] untimely notice of his treaty position “. See further comments at the end of this post and the District Court’s opinion here – Aroeste v United States – Order (Nov 2023). Meanwhile, see below the 22 countries from where global readers viewed Tax-Expatriation.com during the first full week of 2024.

Below is the list of 22 countries (including the United States) from where readers hailed, who read Tax-Expatriation.com during the first week of 2024. All, but Brazil, Croatia, Nigeria, the United Arab Emirates, Colombia, Kenya and Bermuda have income tax treaties with the United States.

This means that all other individuals are connected with the following 14 countries that have tax treaties with the United States:

- Mexico

- India

- Canada

- United Kingdom

- Switzerland

- Australia

- China

- Spain

- Turkey

- Germany

- Japan

- Romania

- Portugal

- Netherlands

Further, all individuals who might have never formally abandoned their lawful permanent residency (“green card”), maybe never filed specific IRS tax forms, and yet reside in one of these fourteen (14) treaty countries could be eligible for the application and the specific benefits of international income tax treaty law. This, along the lines of the decision in Aroeste v United States (Nov. 2023). In addition, there could be other tax treaty benefits applicable to those individuals in these fourteen countries depending upon where are their assets, what type of income they have, where does the income come from, and where do they reside.

The tax treaty rights discussed here are established by law, as elucidated by the Federal District Court in Aroeste v United States (Nov. 2023). The Court determined that the IRS cannot simply assert an individual’s ineligibility for treaty law provisions based solely on the failure to file specific IRS forms within the government-defined “timely” period. The Court emphasized that there is no automatic waiver of treaty benefits as a matter of law, while acknowledging: “. . . Aroeste gave untimely notice of his treaty position. . .” For specific excerpts from the opinion, please refer to the highlighted portions below. To access the complete opinion, please consult Aroeste v United States – Order (Nov 2023).

* * * * * * * * *

B. Whether Aroeste Did Not Waive the Benefits of the Treaty Applicable to Residents of Mexico and Notified the Secretary of Commencement of Such Treatment.

To establish Mexican residency under the Treaty, and thus avoid the reporting requirements of “United States persons,” Aroeste must have filed a timely income tax return as a non-resident (Form 1040NR) with a Form 8833, Treaty-Based Return Position Case 3:22-cv-00682-AJB-KSC Document 90 Filed 11/20/23 PageID.2722 Page 8 of 17 9 22-cv-00682-AJB-KSC Disclosure Under Section 6114 or 7701(b). Indeed, Aroeste did not submit Form 8833 to notify the IRS of his desired treaty position for the years 2012 and 2013 until October 12, 2016, when he submitted an amended tax return for both years at issue. (Id.) The Government asserts that because Aroeste did not timely submit these forms, he cannot establish that he notified the IRS of his desire to be treated solely as a resident of Mexico and not waive the benefits of the Treaty. (Id. at 4.) The Government relies upon United States v. Little, 828 Fed. App’x 34 (2d Cir. 2020) (“Little II”), a criminal appeal in which the court held a lawful permanent resident of a foreign country was a “‘resident alien’ or ‘person subject to the jurisdiction of the United States’ with an obligation to file an FBAR.” Id. at 38 (quoting 31 C.F.R. § 1010.350(a), (b)(2)).

In response, Aroeste asserts that while he agrees with the Government that I.R.C. § 6114 requires disclosure of a treaty position, he disagrees as to the consequences for a taxpayer’s failure to timely file the disclosure. (Doc. No. 75-1 at 6.) While the Government asserts the failure to timely file Forms 1040NR and 8833 deprives individuals of the Treaty benefits provided, Aroeste argues instead that I.R.C. § 6712 provides explicit consequences for failure to comply with § 6114. Specifically, § 6712 states that “[i]f a taxpayer fails to meet the requirements of section 6114, there is hereby imposed a penalty equal to $1,000 . . . on each such failure.” I.R.C. § 6712(a). Based on the foregoing, Aroeste argues the taxpayer does not lose the benefits or application of the treaty law.1 (Doc. No. 75-1 at 6.) In United States v. Little, 12-cr-647 (PKC), 2017 WL 1743837, at *5 (S.D. N.Y. 1 Aroeste further asserts that published agency guidance, letter rulings, and technical advice support his position. (Doc. No. 75-1 at 7.) For example, in 2007, an IRS agent sought advice from IRS Counsel asking, “Do we have legal authority to deny a tax treaty because Form 8833 is not attached or the treaty is claimed on the wrong Form (1040EZ or 1040)?” Legal Advice Issued to Program Managers During 2007 Document Number 2007-01188, IRS. IRS Counsel responded, “No, you cannot deny treaty benefits if the taxpayer is entitled to them. You may impose a penalty of $1,000 under section 6712 of the Code on an individual who is obligated to file and does not.” Id. As to this, the Court finds it has no precedential value under I.R.C. § 6110(k)(3), which states that “a written determination may not be used or cited as precedent.” See Amtel, Inc. v. United States, 31 Fed. Cl. 598, 602 (1994) (“The [Internal Revenue] Code specifically precludes [plaintiff] and the court from using or citing a technical advice memorandum as precedent.”) Case 3:22-cv-00682-AJB-KSC Document 90 Filed 11/20/23 PageID.2723 Page 9 of 17 10 22-cv-00682-AJB-KSC May 3, 2017) (“Little I”), a criminal case for the plaintiff’s willful failure to file tax returns, the court stated the plaintiff’s same argument “that the failure to take a Treaty position can result only in a financial penalty also lacks merit. 26 U.S.C. § 6712(c) expressly states that ‘[t]he penalty imposed by this section shall be in addition to any other penalty imposed by law.’” (emphasis added).

I have been consulted over the years by other taxpayers which are cited now as published decisions by the government and the Federal District Court (Southern District of California). These cases are referenced and cited in my own most recent case of Aroeste v United States (Nov. 2023).

However, in Little I, the plaintiff never attempted to take a treaty position. Next, in Shnier v. United States, 151 Fed. Cl. 1, 21 (2020), the court denied the plaintiffs’ claims for relief based on tax treaties because they failed to disclose a treaty based position on their tax returns pursuant to I.R.C. § 6114 “and did not attempt to cure this omission in their briefing[.]” Although the plaintiffs in Shnier were naturalized U.S. citizens who attempted to recover their income taxes under I.R.C § 1297, the court’s brief discussion of I.R.C. § 6114 in relation to a treaty-based position is instructive that an untimely notice of a treaty position does not bar the individual from taking such position. Moreover, in Pekar v. C.I.R., 113 T.C. 158 (1999), the court noted that a taxpayer who fails to disclose a treaty-based position as required by § 6114 is subject to the $1,000 penalty, but stated “there is no indication that this failure estops a taxpayer from taking such a position.” Id. at 161 n.5.2 The Court agrees with Aroeste.

Although Aroeste gave untimely notice of his treaty position, the Court finds this does not waive the benefits of the Treaty as asserted by the Government. Rather, I.R.C. § 6712 provides the consequences for failure to comply with I.R.C. § 6114, namely a penalty of $1,000 for each failure to meet § 6114’s requirements of disclosing a treaty position.

* * * * * * * * *

For individuals living in any of these 14 tax treaty countries (or any of the total 67 income tax treaty countries), the key takeaway is that, based on their specific circumstances, they might be eligible to leverage the international tax treaty principles outlined in the Aroeste v United States case (Nov. 2023). The forthcoming post will pose questions for consideration by the potentially millions of individuals affected by these rules of law.