The Time has Come: Revocation or Denial of U.S. Passports as IRS Begins Issuing Notices to U.S. citizens

At the end of 2015 (Dec. 9), I posted a description of what was then a new law, passed by Congress – Revocation or Denial of U.S. Passport: More on new section 7345 (Title 26/IRC) and USCs with “Seriously Delinquent Tax Debt”

At the time, it was clear that the IRS and the Department of Justice was going to take a substantial amount of time to actually implement what is a major change in the law. In short, the IRS has the power and obligation to notify the Secretary of State to (i) deny a U.S. citizen (the “Taxpayer”) a U.S. passport, or (ii) revoke or not renew a U.S. passport of the Taxpayer. The law is not clear as to what steps the Department of State will necessarily take in response to the notification.

At the time, it was clear that the IRS and the Department of Justice was going to take a substantial amount of time to actually implement what is a major change in the law. In short, the IRS has the power and obligation to notify the Secretary of State to (i) deny a U.S. citizen (the “Taxpayer”) a U.S. passport, or (ii) revoke or not renew a U.S. passport of the Taxpayer. The law is not clear as to what steps the Department of State will necessarily take in response to the notification.

Now the administrative machine is in full force as the IRS has begun issuing special notices to restrict or ban a U.S. passport of the Taxpayer. See, IRS Notice – Notice 2018–01 and a dedicated portion of the IRS website that focuses on Section 7345 titled Revocation or Denial of Passport in Case of Certain Unpaid Taxes.

The IRS has begun issuing notices required under the law for those  Taxpayers who the IRS asserts have “seriously delinquent tax debt” as defined in the law – Taxpayer Notification – Notices CP 508C.

Taxpayers who the IRS asserts have “seriously delinquent tax debt” as defined in the law – Taxpayer Notification – Notices CP 508C.

The Department of State’s website uses mandatory language regarding revoking, issuing or renewing a U.S. passport of U.S. citizens (“USCs”) once they have received certification from the Secretary of the Treasury –

If you have been certified to the Department of State by the Secretary of the Treasury as having a seriously delinquent tax debt, you cannot be issued a U.S. passport and your current U.S. passport may be revoked.

If you are overseas you may be eligible for a limited passport good for direct return to the United States.

We would suggest that if you have seriously delinquent tax debt, you contact the IRS to resolve your debt before applying for a passport. If you do not resolve your tax issues before applying for a passport, your application will be delayed or denied.

Indeed, a key representative from the IRS personally told me in Washington D.C. this May that the first batch of Notices CP 508C were issued as sort of a test batch of notices. Surely, Taxpayers will be forced to litigate and challenge the validity of these.

For those of us who have dedicated our professional lives to these issues, we see that probably more often than not, IRS notices of amount of taxes owing are erroneous. The IRS will use their own determinations of amount of taxes, penalties and interest owing, as in this example of a USC residing overseas:

There are two different judicial remedies a Taxpayer who is a USC can choose; file a suit in either U.S. Tax Court or a U.S. District Court to determine the validity or erroneous nature of any particular Notice CP 508C.

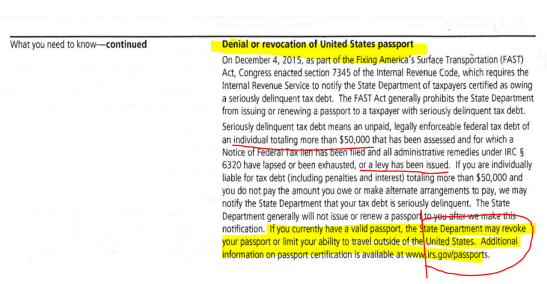

In addition, the IRS is now warning Taxpayers they may lose their passport in Notices of Intent to Levy. The following is sample text from  a recent Notice from the IRS to a USC residing outside the U.S.

a recent Notice from the IRS to a USC residing outside the U.S.

It has been reported that tens of thousands of IRS Notices CP 508C have been issued to Taxpayers during 2018. It remains to be seen the actual numbers of U.S. passports that will be revoked or denied by the Department of State upon receiving notice from the Secretary of Treasury (which notice is certified by the Commissioner of the Internal Revenue Service).

Generally, it will be the IRS Chief Counsel lawyers who litigate these issues before the U.S. Tax Court and the Department of Justice, Tax Division lawyers who litigate before the U.S. District Courts.

This entry was posted in Revocation or Denial of U.S. Passports, Social Security Tax Considerations, Tax Compliance.

One thought on “The Time has Come: Revocation or Denial of U.S. Passports as IRS Begins Issuing Notices to U.S. citizens”

Leave a ReplyCancel reply

This site uses Akismet to reduce spam. Learn how your comment data is processed.

September 20, 2018 at 9:15 pm

[…] See, The Time has Come: Revocation or Denial of U.S. Passports as IRS Begins Issuing Notices to U.S. cit… and Revocation or Denial of U.S. Passport: More on new section 7345 (Title 26/IRC) and USCs with “Seriously Delinquent Tax Debt” […]