The U.S. Civil War is the Origin of U.S. Citizenship Based Taxation on Worldwide Income for Persons Living Outside the U.S. ***Does it still make sense?

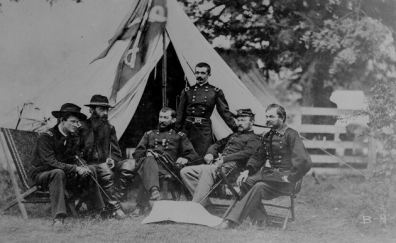

Many people are surprised to learn why (and when) the U.S. federal government first imposed U.S. citizenship based taxation on worldwide income. It was during the U.S. Civil War.

Professor Reuven Avi-Yonah explains in his article why Congress imposed the income tax in 1864 in the Civil War and cites to the Revenue Act of 1864 which imposed worldwide U.S. taxation on:

” . . . any citizen of the United States residing abroad”, regardless of whether the income arose “in the United States or elsewhere.” See, Revenue Act of June 30, 1864, ch. 173, sec. 116, 13 Stat. 223, 281; discussed on p. 3 – The Case Against Taxing U.S. Citizens, Avi-Yonah

The quote of a then Senator during the Civil War who worked on the committee that drafted the initial law in 1861, is illuminating as to its rationale:

We do not desire that our citizens who have incomes in this country…should go out of the country, reside in Paris or elsewhere, avoiding the risk of being drafted or contributing anything personally to the requirements of the country at this time, and get off with as low a tax as everybody else… If a man draws his income from our public debt, or from property here, and resides in Paris, skulking away from contributing his personal support to the Government in this day of its extremity, he ought to pay a higher income tax.

President Abraham Lincoln signed the 1864 tax law that imposed a tax of up to 10% (the highest tax rate at the time) for incomes greater than about US$230,000 in current U.S. dollars (US$10,000 dollars in 1864). The tax expired in 1873.

Does such a system of worldwide taxation on USCs and LPRs residing overseas continue to make sense during the 21st century?

This is, of course, a tax policy question to be left to those who make the laws.

In the meantime, U.S. citizens and LPRs residing outside the U.S. must generally be aware of how the U.S. tax law applies to them. See, USCs and LPRs Living Outside the U.S. – Key Tax and BSA Forms

May 5, 2014 at 10:20 am

[…] federal tax law was originally passed during the Civil War. See, The U.S. Civil War is the Origin of U.S. Citizenship Based Taxation on Worldwide Income for Persons … (Posted on April 1, 2014). The federal tax law is currently codified in Title […]

October 29, 2023 at 8:47 pm

[…] If such an individual who has great earning power can easily enter the U.S. when they wish, hence being able to always control their income tax residency status, why would they ever want become a U.S. citizen? Maybe for political or family reasons? See, a prior post explaining the origins of U.S. citizenship based taxation – The U.S. Civil War is the Origin of U.S. Citizenship Based Taxation on Worldwide Income for Persons … […]