USCs and LPRs Living Outside the U.S. – Key Tax and BSA Forms

U.S. citizens and Lawful permanent residents living outside the U.S. generally have additional tax and financial account (from the Bank Secrecy Act – “BSA”) reporting requirements. These filings are unique for persons who reside in their home country compared to those who reside in the U.S.

The forms and basic concepts that may be applicable are as follows:

A) Foreign Earned Income Exclusion –

The IRS explains the confusion that commonly exists from this form, which is only available from so-called “earned” income (not passive investment type income):

In addition to filing a U.S. tax return, the taxpayer must meet the residency tests and file IRS Form 2555, Foreign Earned Income

A credit is a “dollar for dollar” (subject to various limitations) reduction in the federal tax burden for taxes paid in another country for income sourced in that country.

Importantly, as the government explains, ” . . . Once you choose to exclude either foreign earned income or foreign housing costs, you cannot take a foreign tax credit for taxes on income you can exclude. If you do take the credit, one or both of the choices may be considered revoked. . . ”

In addition to filing a U.S. tax return, the taxpayer must meet various conditions for eligibility for the foreign tax credit. The calculation is complex and is ultimately reported on IRS Form 1116 and must be attached to the income tax return, which will always be IRS Form Form 1040 for U.S. citizens and LPRs who reside in a country with no U.S. income tax treaty; and could be IRS Form 1040NR for certain LPRs residing in a country with a U.S. income tax treaty.

C) Information Reporting Requirements

There can be multiple reporting requirements, depending upon the type of transaction, foreign asset, etc.

A summary of these reporting requirements is set forth towards the end of the article “Accidental Americans” – Rush to Renounce U.S. Citizenship to Avoid the Ugly U.S. Tax Web” International Tax Journal,CCH Wolters  Kluwer, Nov./Dec. 2012, Vol. 38 Issue 6, p45.

Kluwer, Nov./Dec. 2012, Vol. 38 Issue 6, p45.

In addition to the forms reflected in the article, IRS Form 8938 Statement of Specified Foreign Financial Assets became part of the law for 2011 tax year filings in 2012. There is often overlap of reporting on this form and the FBAR referred to below.

This form 8938, along with most other forms must be attached to your income tax return (e.g., IRS form 1040) when filed with the IRS. It is common for most types of tax preparation software NOT to have support for this and other particular forms that must be filed regarding non-U.S. assets. Accordingly, the forms often times need to be completed manually by using an Adobe Acrobat version.

D) Foreign Bank Account Reports (“FBAR”)

The definition of “ownership interest in” or “signature authority over” is very broad under the FBAR regulations. See, FOREIGN BANK ACCOUNT REPORTS – 2011 REGULATIONS EXTEND RULES TO MANY UNAWARE PERSONS

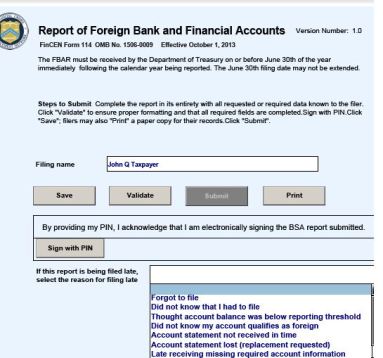

The filing of the FBAR form is not with the IRS, but rather with FinCEN. It must now be filed electronically on Form 114, Report of Foreign Bank and Financial Accounts through the BSA E-Filing System website. The electronic form supersedes TD F 90-22.1 (the FBAR form that was used in prior years).

The filing of the FBAR form is not with the IRS, but rather with FinCEN. It must now be filed electronically on Form 114, Report of Foreign Bank and Financial Accounts through the BSA E-Filing System website. The electronic form supersedes TD F 90-22.1 (the FBAR form that was used in prior years).

The penalties for not filing or even filing late are by statute $10,000 for each failure to file (or up to 50% of the account balances when intentionally not filed by the person with the requirement to file).

* Simply More Compliance Obligations for Persons Residing Outside the U.S.

At the end of the day, a USC or LPR residing outside the U.S. necessarily has a much greater burden of tax compliance and filings of these forms, compared to someone living in the U.S. without foreign bank accounts, foreign assets, foreign income, etc.

请点击这里查看本帖子的中文版本。 (Please click here to view the above in Chinese.)

March 18, 2014 at 3:22 pm

[…] in one of the above categories need to take to help assure they have met this requirement? See, USCs and LPRs Living Outside the U.S. – Key Tax and BSA Formsfor a basic overview of the foreign earned income law and forms, foreign tax credit law and forms […]

March 20, 2014 at 2:50 pm

[…] This is true, even if all of the income is earned income and eligible for the foreign earned income exclusion, which is US$97,600 for the year 2013. See, USCs and LPRs Living Outside the U.S. – Key Tax and BSA Forms […]

March 21, 2014 at 3:07 pm

[…] There is also a very different tax form used for the FTC as compared to the FEIE. See USCs and LPRs Living Outside the U.S. – Key Tax and BSA Forms […]

March 22, 2014 at 1:14 am

[…] Lo anterior es cierto, incluso si todo el ingreso es obtenido o ganado en el extranjero y resulta elegible para la exclusión del ingreso ganado en el extranjero, la cual es de USD $97,600 para el anno 2013. Ver, USCs and LPRs Living Outside the U.S. – Key Tax and BSA Forms. […]

March 22, 2014 at 5:23 am

[…] También se emplea una forma del IRS distinta para el FTC a la empleada para el FEIE. Ver. Ciudadanos Americanos y Poseedores de Green Card que Viven Fuera de los EUA – Formas Clave y BSA. […]

March 22, 2014 at 5:32 am

[…] También se emplea una forma del IRS distinta para el FTC a la empleada para el FEIE. Ver. Ciudadanos Americanos y Poseedores de Green Card que Viven Fuera de los EUA – Formas Clave y BSA. […]

March 22, 2014 at 2:08 pm

[…] grupos antes mencionados para asegurarse que ha cumplido con este requisito (certificación)? Ver, Ciudadanos Americanos y Poseedores de Green Cards que Viven Fuera de los EUA –Formas Fiscales Clav…, para una explicación básica del ingreso generado u obtenido en el extranjero, sobe la ley y […]

March 27, 2014 at 3:21 pm

[…] Assume, however, that her Missionaries of Charity that operated in over 100 countries had some 50 accounts in countries outside the U.S. where Mother Teresa had signature authority over such accounts in 1996. In such a scenario, since Mother Teresa was an “honorary citizen” during that year, she presumably was a “U.S. person” under Section 7701 of the Internal Revenue Code. She would therefore also have been subject a host of other tax and filing requirements as a U.S. citizen. See USCs and LPRs Living Outside the U.S. – Key Tax and BSA Forms. […]

April 1, 2014 at 3:31 pm

[…] In the meantime, U.S. citizens and LPRs residing outside the U.S. must generally be aware of how the U.S. tax law applies to them. See, USCs and LPRs Living Outside the U.S. – Key Tax and BSA Forms […]

April 1, 2014 at 6:48 pm

[…] Supongamos, sin embargo, que sus misioneras de la caridad que operan en más de 100 países, tenían unas 50 cuentas en esos otros países fuera de los Estados Unidos donde la Madre Teresa tenía autoridad de firma sobre esas cuentas en 1996. En tal escenario, puesto que la Madre Teresa era “ciudadano honorario” durante ese año, presumiblemente era una “persona estadounidense” bajo la sección 7701 del código de rentas internas. Por lo tanto, también habría sido sujeta a una serie de otros impuestos y requisitos de presentación como ciudadano estadounidense. Véase: “Ciudadanos de los Estados Unidos y los Residentes Legales Permanentes viviendo fuera de los E…. […]

April 2, 2014 at 2:31 pm

[…] I have put a number of posts regarding FBARs – foreign bank account reports. See, When does the Statute of Limitations Run Against the U.S. Government Regarding FBAR Filings? and USCs and LPRs Living Outside the U.S. – Key Tax and BSA Forms […]

April 3, 2014 at 3:03 pm

[…] FBARs are often duplicate with tax provision reporting – specifically, IRS Form 8938. See,USCs and LPRs Living Outside the U.S. – Key Tax and BSA Forms and USCs and LPRs residing outside the U.S. – and IRS […]

April 10, 2014 at 12:29 am

[…] Entretanto, los CEU y RLP que residen fuera de los Estados Unidos generalmente deben tener en mente cómo les aplica la ley de impuestos de los Estados Unidos. Los CEU y RLP que viven fuera de los Estados Unidos – impuestos clave y las formas BSA […]

April 12, 2014 at 3:33 pm

[…] In this notice, the IRS does not emphasizes the draconian penalties that befall these taxpayers for not filing international information returns or FBARs. The minimum civil penalties for failures to file these forms is almost always at least US$10,000. See, USCs and LPRs Living Outside the U.S. – Key Tax and BSA Forms. […]

April 13, 2014 at 6:01 pm

[…] There are rarely good and efficient U.S. international tax return preparers who understand the specific tax rules in the various countries and specific locations where USCs and LPRs live. See, USCs and LPRs Living Outside the U.S. – Key Tax and BSA Forms […]

April 15, 2014 at 7:39 pm

[…] 2. Informes Duplicados. Los FBARs suelen ser duplicados con los reportes fiscales de provisión – específicamente, la Forma IRS 8938. Ver CEUs y RLPs viviendo Fuera de los Estados Unidos – Impuestos clave y las formas BSA y también CEU… […]

April 29, 2014 at 11:40 pm

[…] En este aviso, el IRS no acentuar las sanciones draconianas que ocurran a estos contribuyentes por no presentar sus declaraciones informáticas internacionales o FBARs. Las penalidades civiles mínimas por la falta de no presentar estas formas son al menos US$ 10, 000. Vea Ciudadanos de los Estados Unidos y Residentes Legales Permanentes que viven fuera de los Estados Uni…. […]

April 30, 2014 at 9:38 am

[…] A basic point in the law that is not well understood is the due date for filing federal income tax returns for USCs and LPRs (where the LPR is a resident, absent a treaty override) residing outside the U.S. Generally both must file IRS Form 1040. See, USCs and LPRs Living Outside the U.S. – Key Tax and BSA Forms […]